Deal Flow Predictor for Q1 2024

Get an exclusive preview of global and regional M&A activity for the next six months

Download the latest edition of the SS&C Intralinks Deal Flow Predictor featuring our proprietary, data-driven mergers and acquisitions (M&A) market predictions for the next six months — by region, sector and deal type.

This issue also includes:

- An expert’s perspective on the link between board-level gender diversity and deal leaks

- A spotlight feature on why more deal teams are leveraging outsourcing

Download the Report

Plus, read our spotlight feature on environmental, social and corporate governance (ESG) and its increasing importance in corporate and private equity dealmaking. Learn about:

- ESG’s adoption by region and country – with Europe leading the way

- ESG challenges, opportunities and impact on decision-makingt

- Why companies with a strong ESG commitment experience increased investor interest

- Creating value for private equity through ESG

About the Intralinks Deal Flow Predictor

Content highlights

- Interactive predictions on global, regional and sector data

- Featured spotlights on the most topical issues

- Q&A with industry leaders

Accurate Prediction

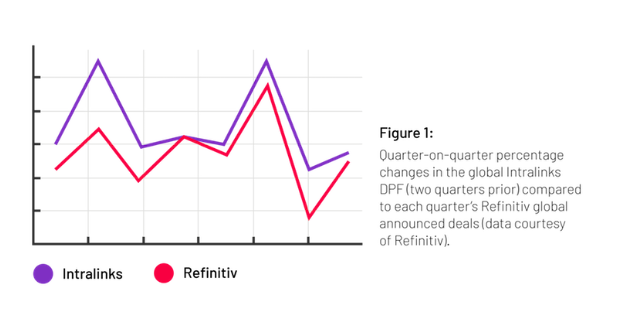

The SS&C Intralinks Deal Flow Predictor has been independently verified as an accurate six-month forecast of future changes in the worldwide volume (number) of announced M&A transactions, as reported by Refinitiv. Refinitiv’s data on announced deal volumes for the past four quarters has been adjusted by Intralinks for expected subsequent changes in reported announced deal volumes in Refinitiv's database.

Find out how the Intralinks Virtual Data Room can help you get your deals done faster.

Related Resources

Our model

The SS&C Intralinks Deal Flow Predictor tracks global M&A sell-side mandates and deals reaching the due diligence phase prior to public announcement, providing a unique leading indicator of future global deal activity. The Intralinks Deal Flow Predictor is based on the company’s insight into a significant percentage of M&A transactions in their initial phases.

Learn more