Does M&A Diligence Still Matter?

30 June 2021A panel of experts weighs in on Tech’s impact on this vital step in the dealmaking process.

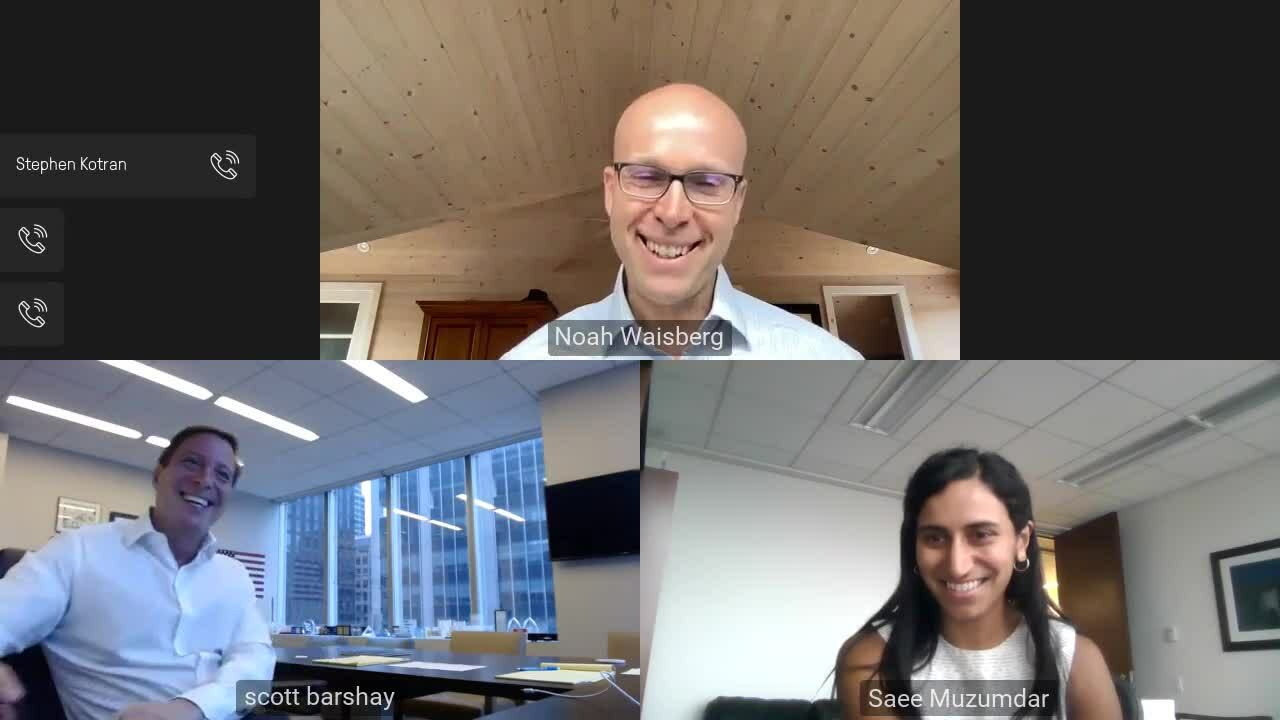

Against the backdrop of a buoyant mergers and acquisitions market, SS&C Intralinks recently hosted an expert roundtable session exploring whether M&A diligence still matters. The session, moderated by Noah Waisberg, CEO/co-founder of Kira Systems, focused on the legal aspects of diligence. The experts, all partners with prominent law firms, shared real-life examples from their vast trove of dealmaking experience. Recognizing the importance that technology is playing in every area of M&A, the panel also discussed the role of artificial intelligence (AI) in the legal-diligence process.

Noah started the session by playing devil’s advocate, stating that he was hearing about the decline in the relevance of diligence, pointing to clients’ cost sensitivity and increasing time pressures allowing only a cursory glance at the target. This comment raised a chuckle from all of the panelists.

Scott Barshay, Chair of the Paul, Weiss Corporate Department, stated that while there is a lot in an M&A process that does not matter, diligence does in fact matter a lot. He highlighted particularly Technology deals where diligence was crucial in establishing ownership of software and intellectual property. Saee Muzumdar, a partner at Gibson Dunn, agreed, stating that the diligence process is an exercise in which every person involved in the deal should be engaged. Stephen Kotran, a partner at Sullivan & Cromwell, felt that the value of diligence was fundamentally an empirical question. He pointed out how private equity (PE) funds and other serial acquirers were increasingly looking at data to support the value proposition of diligence. Instead of suggesting less diligence, he felt buyers should be looking at more, but different, diligence.

Technology’s role in diligence

Technology is having an impact on legal diligence. Smart diligence, supported by AI, is now part of the overall diligence process. Saee pointed out that like many professions, the legal field was being disrupted by technology. She stated that technology is enabling diligence to change and focus on more specific areas. This raised the question as to whether tech should be used to expand the areas under review. Scott stated that while every deal is different, AI helps him to do his job for clients, more so now than ten years ago. He recognized AI as a tool to help reduce the cost to clients. Stephen acknowledged that AI was getting better and cheaper as time goes on but questioned whether one could remove the human element from the diligence process.

The panelists also discussed how the extensive use of reps and warranties, predominantly by private equity players, has changed the nature of diligence and whether having a PE fund involved in the deal changes the dynamics of the diligence process.

The key takeaway from the session was the continued value of a thorough diligence process, supported by experts, in creating value in an M&A transaction. Technology has a role to play in this process, but human interaction and communication remain crucial to success.

To watch the full video, please click the play button below.

Brian Hwang

Brian S. Hwang is Director of Strategic Business & Corporate Development at Intralinks. Brian joined Intralinks from RR Donnelley Global Capital Markets where he primarily worked with clients in the Midwest and Northeast, consulting on initiatives related to disclosure issues for SEC financial reporting, US Proxy compliance and transactional due diligence. Brian started his career with New York City law firm Wachtell, Lipton, Rosen & Katz, where he was involved in the due diligence and execution of transactions, valued at over $350 billion.