Intelligently done.

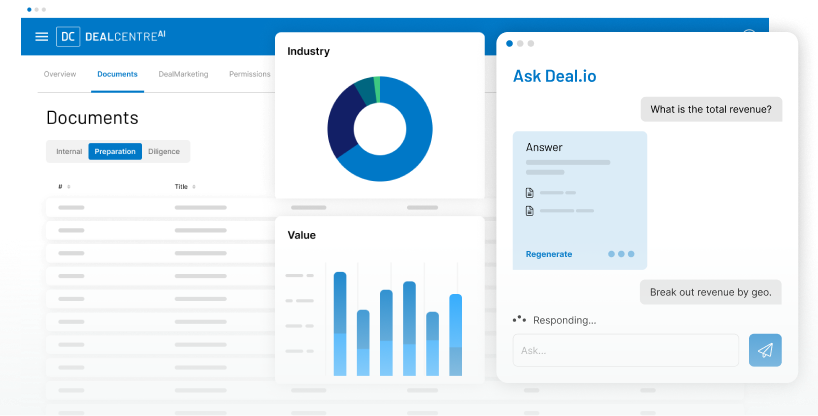

DealCentre AI™ is a purpose-built, AI-powered dealmaking platform that transforms the way deals are done.

DealCentre AI gives you an edge across the entire deal lifecycle

From automating tedious tasks, accurately solving complex problems and revealing unique insights, DealCentre AI can speed and streamline your deal like never before — all within a seamless, single–platform experience.

Features

Manage the entire deal lifecycle in one location

Gain complete visibility into your deal pipeline

Launch deals faster with self-launch deal prep

Easily identify and remove duplicate tasks to save time

Leverage DealMarketing for seamless buyer outreach

Perform in-app conversion to PDF

Run document analyzer to identify password-protected docs

Manage buy-side checklists

Uncover insights from previous deals completed

Optimize team resources through end-to-end deal transparency

Charting the AI Course

We convened 30 senior-level dealmakers for a discussion on the implications of AI in M&A dealmaking. This white paper uncovers six takeaways arising from the group's discussion.

From deal transaction to deal transformation – powered by Deal.io

DealCentre AI is powered by Deal.io, our proprietary AI engine that uncovers analytics and insights from past deal data to optimize resources for future transactions while delivering:

Single Platform Experience

View individual or multiple deals within a single, unified platform

Platform

Intelligence

Harness past deal data for greater insights

AI-Powered

Workflows

Accelerate deal timelines to enhance potential of deal success

Real-Time

Collaboration

Enable sharing of crucial information between deal team members

Our experts are leveraging AI to revolutionize dealmaking

Intralinks has dedicated years to investing in AI and the development of sophisticated large language models (LLMs) for years. This endeavour has led to our proprietary AI engine fuelling a complete suite of capabilities within DealCentre AI. Its impact extends across every aspect of the deal lifecycle, delivering substantial benefits.

Automating tedious tasks, accurately solving complex problems and revealing deep insights, DealCentre AI can speed and simplify your deal like never before.

Experience the latest AI innovation we're working on in action.

Our experts:

Prakash Kanchinadam

VP, Engineering

SS&C Intralinks

Scott Moeller

Director M&A Research Centre

Bayes Business School City, University of London

Ashwin Moranganti

VP, Product

SS&C Intralinks

The Real Deal Podcast

In this episode, we discuss how AI is factoring into all aspects of dealmaking and explain how the right strategy can help the sell-side achieve an “AI premium.”

Transcript

In this week’s episode, we’re looking at how the use of artificial intelligence (AI) has exploded with the proliferation of ChatGPT and other tools. We discuss how the technology is factoring into all aspects of dealmaking and explain how the right strategy can help the sell-side achieve an “AI premium.” Joining host Julie-Anna Needham is Gustav Hoejmark-Jensen, a senior reporter for Mergermarket covering software and technology for the Nordic and DACH regions.

Dealmakers, download the SS&C Intralinks Deal Flow Predictor for Q4 2023 to see our data-driven prediction on where M&A will go globally and regionally in the next six months: https://www.intralinks.com/deal-flow-predictor

*****

Transcript

Julie-Anna (00:04): Hello and welcome to Dealcast, the weekly M&A podcast presented to you by Mergermarket and SS&C Intralinks. I'm Julie-Anna Needham. I'm a business journalist who's been covering M&A for a decade. Now the use of AI has exploded in the past year with the proliferation of ChatGPT and other tools. But how does AI factor into deal discussions when it comes to software and technology deals? To find out more, I'm joined by Gustav Høejmark-Jensen, who's a senior reporter for Mergermarket, covering software and technology for the Nordic and DAC regions. Hi Gustav, thanks for joining me today.

Gustav (00:44): Thanks, Julie-Anna.

Julie-Anna (00:45): So, can you start by explaining how the software and tech-enabled services sector have been impacted by AI, but particularly from a deal-making perspective, please?

Gustav (00:57): Sure. I think from speaking to lots of sources across Europe, I mean software and tech-enabled services has been affected by AI for quite a while, but definitely there's been a new sort of emergence of AI related questions when it comes to dealmaking strategies relating to how a provider or a platform either has or will incorporate AI into offerings and workflows. And also, you have bankers on either side of the table, either sell-side or buy-side, basically angling for either a premium or a discount because of potential disruption in the future. And also, I don't think there's any doubt about the fact that it's quite a central part of the deal making process now when it comes to tech and software. I think it probably was before ChatGPT came around, but it's definitely more prevalent now.

Julie-Anna (01:56): Thank you. And could you tell us how deal makers are handling the questions around AI when it comes to deal multiples and also investment returns?

Gustav (02:07): Sure. I think, again, we have to look at AI as being divided into a few different brackets when we talk about transactions and multiples and valuations. And it's not all transactions where AI is a relevant parameter, but we can come back to a few of those sectors later. I think now one will argue that there are different kinds of basically creating the argument for an AI premium and also for an AI discount. And it seems, when I see, so the vast majority of teasers and information memorandums that I come across, they mention AI in either form. Either it's like what are we going to do about AI in the coming years, or what have we done already and why should we be paid more for our efforts in this space? And I think the really interesting thing is to look at the different approaches that both banks and sponsors and investors have in terms of calculating the effect of AI and also its effect on longer term growth and whether this is truly sustainable because at some point it'll become the new normal. So, you can't really gain an advantage just by being sort of AI ready or AI active.

Julie-Anna (03:28): So, the AI premium might be like an ESG premium, for example.

Gustav (03:33): Yeah, I mean you could definitely sort of compare it to that. I think it has to be part of the conversation now, and I think every sort of sponsor out there will be thinking about how AI is going to come to this business at some point.

Julie-Anna (03:51): And Gustav, do you have any examples of particular deals?

Gustav (03:55): Yeah, so I remember we covered quite a large U.K.-based software testing business called Qualitest. I think we covered it at the beginning of this year, back in January. It's quite a big company. They do between 80 and 100 million in EBITDA, so quite a chunky one. And this deal actually was put on hold because there was just too many questions around AI and there was too many questions from the sponsor side as to how AI was going to basically change the business model. Because what they do is that they test software in many different kind of ways and in many different environments, and AI has played a big role there. And they also provide AI testing. And I think many sponsors just were looking for a bit of clarity, which wasn't really there in terms of how they got to the valuation that they got to, because obviously the sell-side was very keen on cashing in on their AI capabilities, but the sponsors and the buyers out there couldn't really get to the same kind of multiples with AI.

(05:04): And that kind of shows this discrepancy between the two sides of the table when it comes to AI. They have very different ways of calculating value, and I think obviously it's to be expected for businesses like this, but it's also becoming a lot more contentious, I think. And this situation was actually, it was pretty advanced, and I think it was just a matter of the fact that they couldn't justify price because there was uncertainty over AI. And I mean, overall, the bankers that I speak to say that AI will be this great accelerator and enabler, but it'll still come with quite a significant portion of what could be maybe phrased as AI risk. I know that AI risk is a term that many bankers work with in terms of whether there's future disruption on the horizon, and they also start to employ these sort of AI-affected multiples, AI discounts and AI premiums.

Julie-Anna (06:09): And I guess that things are moving so fast. People have said it is kind of the next frontier of the digital revolution that it must be really hard to understand valuations. And you mentioned this deal that was announced at the beginning of the year, perhaps if it was announced later on this year or revisited now, the perspective would be very, very different. And the valuation might be very, very different because people have seen with the explosion of ChatGPT, people have seen how things are moving in that direction significantly.

Gustav (06:45): So, just to clarify, actually the deal wasn't announced. There was a story that we put out in terms of the owners having appointed banks for the deal to eventually for the business to eventually come to market. Nothing ever materialized, which is what I meant with it being put on hold. So, I think they would've loved to announce something, and I think they're, they're going to try again once there was more clarity around these things. It was just to emphasize the fact that AI can trip up some quite big deals out there because there is still a gap between where the buyers are, where the sellers are in terms of valuation and how to value AI.

Julie-Anna (07:28): And I think with just about every other transaction as well. But not every sector has been affected by AI has it, could you talk about some of those that it hasn't reached yet?

Gustav (07:39): Yeah, so actually I thought personally that it was going to come for lots of businesses in the consulting sector because lots of businesses that basically they deal in the space just between tech and IT services and how to integrate various offerings and software platforms and so on. And I thought consulting is basically based on having lots of data, lots of past cases, and from there on you can basically provide the best solution for clients. So, I thought that this was a prime victim for some of the AI questions, but actually consulting has proven quite resilient to AI. And when I speak to bankers and I ask them why hasn't consulting for example, been disrupted by AI? They say that, look, it's still, I mean the funny thing with consulting is that it's very much a people's business. So, it's very much dependent on personal relationships, having recurring clients that you build up a relationship with. And I think ultimately that's still more important than an AI suggesting a great solution because there's still someone to look in the eye and there's still someone to come into office and implement these things. Of course, I mean AI is going to, as the bankers also mentioned, they're going to accelerate different things in terms of workflows of what consultancies can do, but it's still, and I was surprised some of these people, businesses are proving to be more resilient than I had imagined.

Julie-Anna (09:18): So, crystal ball time, let's look at how AI can evolve in this sector. Where do you see the future for it in the next say five years time?

Gustav (09:30): It's always incredibly difficult to predict. So, with that disclaimer, I'm going to say that AI is going to be, I think a core element of valuation talks in this space going forward when it comes to software and tech. I think any business out there that is coming to market, if the sales side isn't prepared to answer very critical questions on AI and how AI is going to affect the business, they're not going to fetch the highest possible price. I think on the other hand, if you have a very clear definition of AI strategy, how you're putting yourself ahead in the market, I think you can definitely still get sort of an AI premium, but I think the premiums are going to fall away and it'll be more a case of how big of a discount will be implemented if you don't do the things that become standard in a few years.

(10:24): And I think a lot of education out there is going on. I think a lot of the major banks, but also the boutiques are spending lots of time trying to understand AI much better because it is still, I mean, it's been around for some time, but definitely become part of the discussions I think in a higher to higher degree now. And I think as bankers and sponsors as well continue to educate themselves, we'll see much more sophisticated valuation models and much more. I think the gap is going to lessen more and more as we go forward, and I think you can have some more, maybe even more fruitful discussions on how AI can be part of future growth.

Julie-Anna (11:09): That's great, Gustav, thanks very much.

Gustav (11:11): Thanks, Julie-Anna. Thank you.

Julie-Anna (11:13): That was senior reporter, Gustav Høejmark-Jensen. Thanks for listening to Dealcast presented by Mergermarket and SS&C Interlinks. Please rate review and follow the podcast. You'll find us on Apple Podcasts, Spotify, or look out for your Mergermarket news alert. For more information, have a look at our show notes. Join us again next week.