Ein guter Start führt zu einem großartigen Deal.

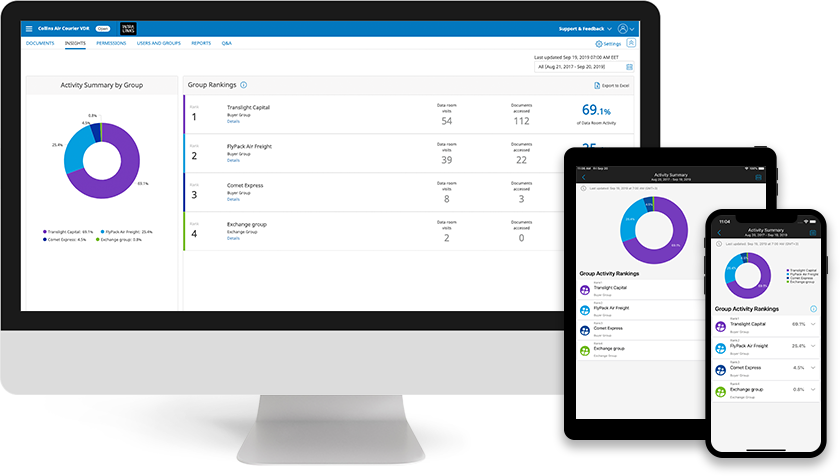

Beschleunigen Sie Ihren Deal mit dem virtuellen Intralinks-Datenraum

- Laden Sie Deal-Dokumente sofort hoch

- Bezahlen Sie nur, wenn der Deal weitergeht

- Verwenden Sie KI-gestützte Due-Diligence-Tools

- Maximieren Sie die Sicherheit und Vertraulichkeit Ihrer Deals*

* Intralinks ist der einzige Anbieter von virtuellen Datenräumen, der die Anforderungen des strengsten Datenschutzstandards der Branche erfüllt: die ISO 27701-Zertifizierung.

Vor über zwei Jahrzehnten haben wir den virtuellen Datenraum etabliert und sind seitdem der führende Anbieter für innovative Finanztechnologie. Über 99 % der Fortune-1000-Unternehmen verlassen sich auf Intralinks.

Von uns für Sie optimiert.

Unsere bewährte Plattform ist die weltweit bevorzugte Lösung für schnelle,

sichere und hoch vertrauliche Geschäftsabschlüsse und Transaktionen.

Sicherer.

Vertrauliche Inhalte sicher teilen – Compliance einhalten.

Einfacher.

Konzentrieren Sie sich auf Ihre Deals, nicht auf die Technologie dahinter.

Intelligenter.

Sparen Sie Zeit und vermeiden Sie kostspielige Fehler.

Service und Support 24/7

Unsere Kunden

Wer wir sind

Mehr als 4 Millionen

10.000+ M&A-Deals

34,7 Billionen US-Dollar

Intralinks bot uns eine sichere, zuverlässige und flexible Lösung, die unseren Anforderungen entsprach. Wir haben viel Zeit und Geld gespart und werden die Lösung mit Sicherheit für weitere Projekte wieder verwenden.