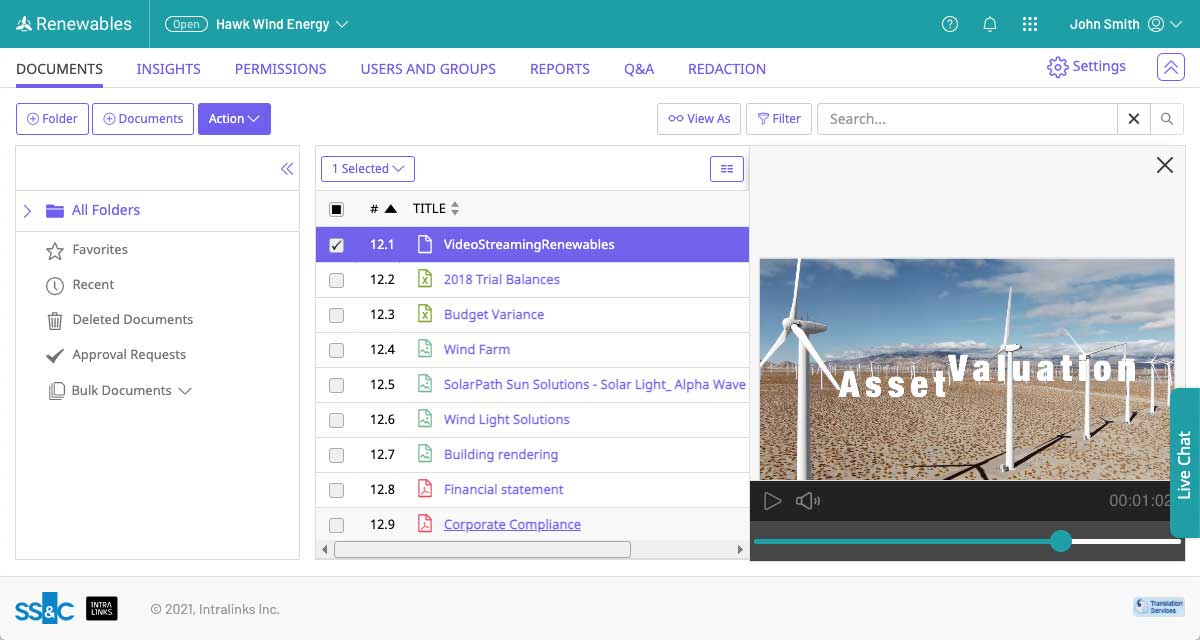

DealCentre™ for Energy

and Renewables

Tap unlimited power

Charge your energy deals with:

- Complete, AI-powered platform for energy dealmakers

- Self-launch deal prep for greater control

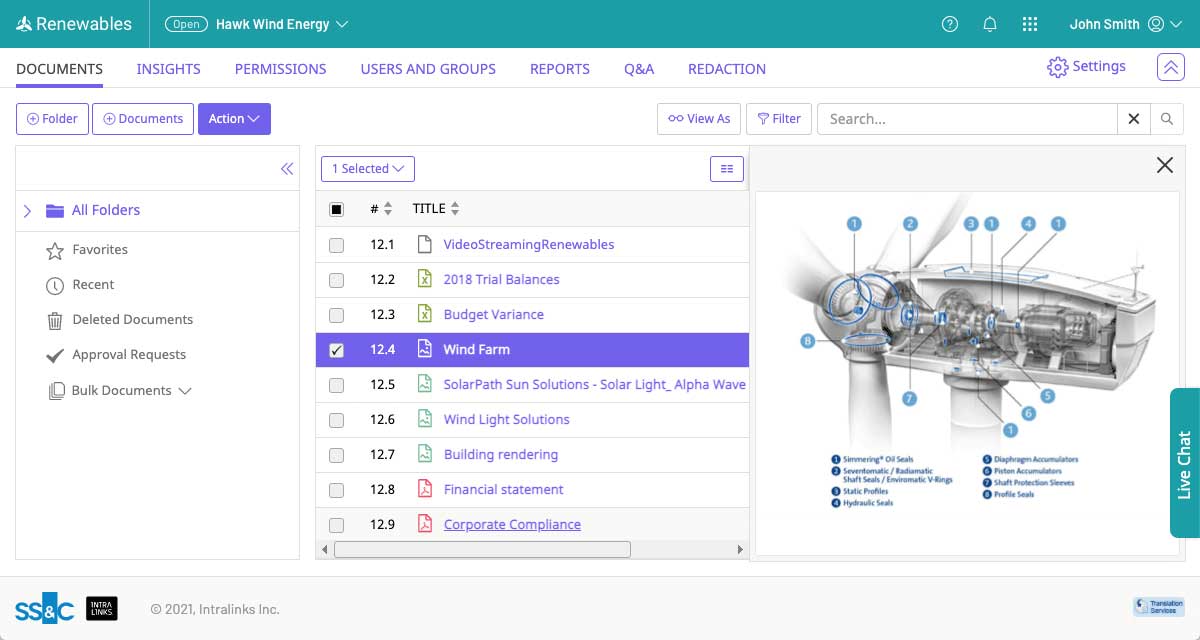

- In-line CAD viewing for well-core logs, seismic data, surveys and more

- Managed services to alleviate tedious tasks

- Award-winning customer support and consulting services

Done deals. Done well.

USD 1.2 billion

USD 2.7 billion

an independent, listed oil and gas producer based in Texas, used Intralinks in its acquisition by Noble Energy for USD 2.7 billion.

USD 6.7 billion

USD 600 million

Benefits

Avoid power failures.

Energy and Renewables deals can be complex, requiring resource-intensive disclosures and immense data requirements. Harness the power of DealCentre for Energy and Renewables to accelerate due diligence, enhance data security, automate workflows and streamline collaboration with buyers, investors, regulators and other key stakeholders. Utilize our best-in-class security measures and robust data privacy protocols for a streamlined and efficient experience.

Unlimited potential energy.

Intralinks’ innovative DealCentre platform fuels a full range of energy deals and renewables projects, including:

- M&A and strategic financing: Gauge interest from buyers and investors; manage teasers, CIMs, NDAs and more.

- Regulatory compliance: Track documentation for exams, audits, inspections, licenses and permits.

- Physical asset management: Manage maintenance of facilities, real estate and equipment; organize documents for insurance claims.

- ESG due diligence: Centralize impact assessment reports for regulators, investors and stakeholders.

- Intellectual property (IP) protection: Guard patents, trade secrets, research findings, proprietary technology and more.

DealCentre

Features

Get the right answers from an experienced team

Keep deals moving even while on the go, from anywhere

Protect PII and other sensitive content – without ever leaving your virtual data room (VDR)

Share documents safely and revoke access permanently – even after download

Machine learning, enhanced analytics and content categorization

Target, track, and engage with your best buyers faster