良いスタートが、最高のディールをもたらします。

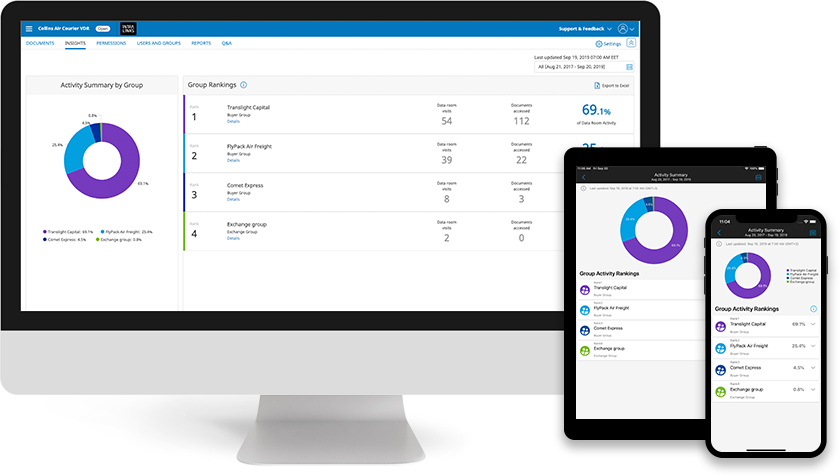

イントラリンクス バーチャルデータルームであなたのディールを加速

- ディール文書を今すぐアップロード

- ディールが成立した場合にのみ支払い

- AI搭載のデューデリジェンスツール

- ディールセキュリティとプライバシーを最大限に*

*イントラリンクスは業界最高のプライバシー 標準ISO 27701認証を得た唯一のVDRプロバイダです。

最新のニュース

お客様の業務を効率化

当社が誇る長年にわたり信頼を築いてきたプラットフォームは、価値の高いディ

ールメーキングと取引を迅速かつ安全に行うためのソリューションとして、世界中で採用されています。

より安全に

コンプライアンス を遵守しながら自 信を持って情報を 共有します。

よりシンプルに

テクノロジーに 煩わされること なく、ディール に集中できま す。

よりスマートに

時間を節約し、 コストのかかる エラーを未然に 防ぎます。

サービスとサポート

お客様

会社紹介

410万以上

年間 10000+件の M&Aディール

34.7兆 米ドル以上

銀行関係者として、機密文書を共有する際に細心の注意が必要なことは理解しています。イントラリンクスを利用すると、文書の数に関係なく、確認するのは1つのソースのみです。そのため、セキュリティの保持や管理がしやすくなり、セキュリティ侵害や不正な文書共有を心配する必要がありません。