The M&A Tide Is High … and Rising

3 November 2021Our exclusive market survey, produced in association with Mergermarket, reveals that dealmakers’ spirits are high — and activity will continue to boom in 2022.

At the onset of the global COVID-19 pandemic in Q1 2020, which necessitated lockdowns and travel bans to slow the spread of the disease, it would have been difficult to imagine how hot the M&A market would become just a few months later. As vaccine programs have ramped up around the world, economic activity has sprung back to life — and a deluge of deals have followed. In Q2 2021, global M&A value reached USD 1.51 trillion — an all-time quarterly apex.

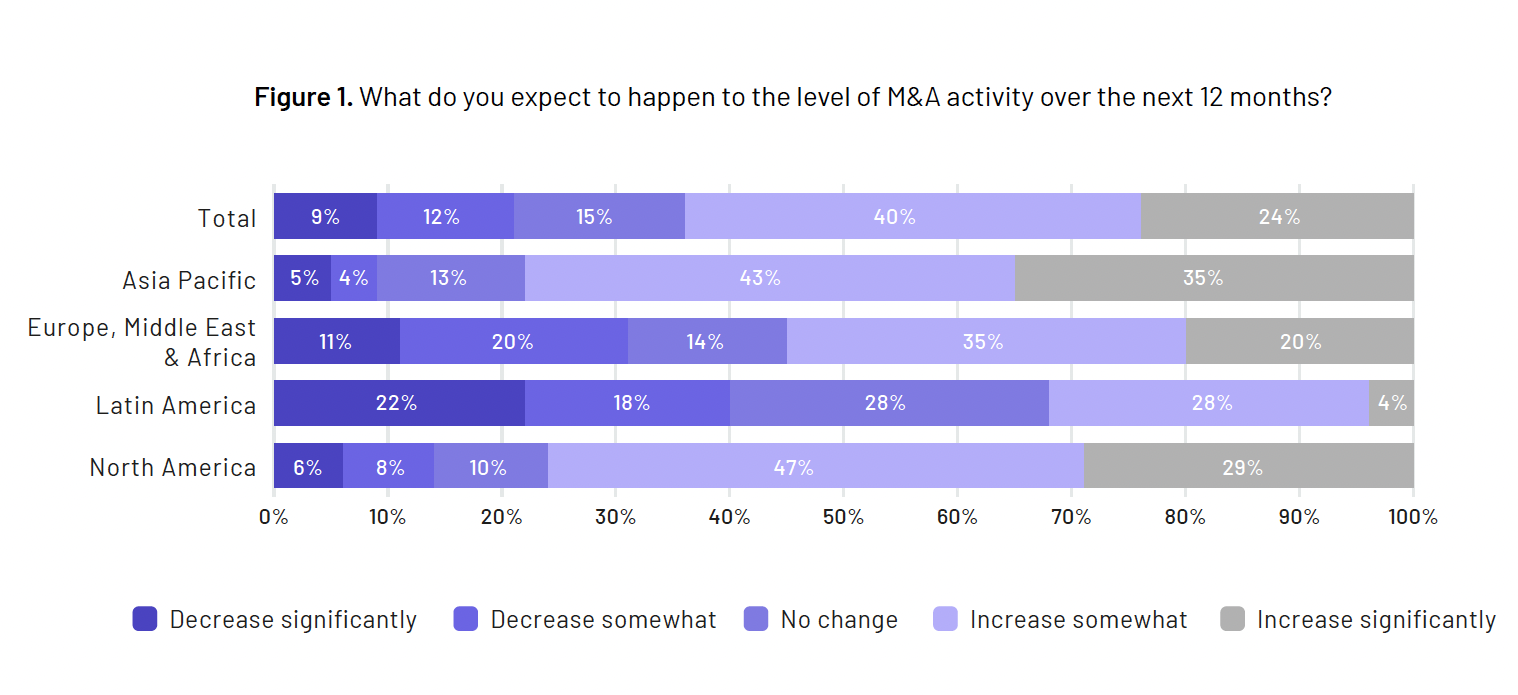

These positive conditions have renewed investor confidence and that sentiment shows little sign of dimming. Our exclusive new survey, Global M&A Dealmakers Report 2022, produced in association with Mergermarket, reveals that almost two-thirds (64 percent) of dealmakers expect M&A activity to increase over the next 12 months, from what are already historically high levels. Almost a quarter (24 percent) expect activity to increase significantly.

Appetite for construction

On the surface, it may be hard to see how a global pandemic could stoke confidence. Certainly, the restrictions placed on day-to-day life have complicated deal processes, with due diligence having been conducted remotely over the past two years.

At the same time, unprecedented liquidity has backstopped financial markets. Acquirers have also been making up for lost time, having sat on the sideline in early 2020. Total worldwide M&A value in Q2 last year collapsed to levels not seen since late 2009 when the global financial crisis pulled the rug out from under the market.

Another factor to consider is the sectoral bifurcation that the pandemic has precipitated. Just as there have been big losers in areas such as Consumer Services and Travel, there have been major winners, such as businesses in the Tech space. And for the right investor, both categories represent a buying opportunity. Our survey shows that more than half (51 percent) of respondents say that COVID-19 increased their dealmaking appetite — and 13 percent say it increased significantly.

Optimism abounds in the private market

Private equity (PE) has been especially bullish here. Just four percent of PE firms say their appetite has significantly decreased post-COVID, compared with 16 percent of corporates. The industry has been a major catalyst for the recent M&A boom. In the first half of 2021, PE made more than USD one trillion worth of deals, a threshold it has never previously crossed.

Corporates continue to take stock, reviewing their strategies and operations for opportunities to divest and reallocate capital, feeding investor appetite for deals. Our report finds that three in ten respondents expect one of the two most important trends in the aftermath of COVID-19 will be an uptick in carve-outs, with 15 percent seeing this as the single most definitive trend. To be sure, there will be no shortage of PE funds snapping up these unwanted assets. Click here to read the full report.

Ken Bisconti

Ken Bisconti is a Co-Head of SS&C Intralinks. In this role, Mr. Bisconti is responsible for the end-to-end management of the organization along with Bob Petrocchi. He formerly served as Chief Product Officer for Intralinks where he developed a very deep and insightful understanding of market needs and strategic opportunities for Intralinks and put those insights to work defining the organization's product offerings.