Impact Investing Influencing General Partner-Limited Partner Relationships

4 April 2022According to the 2022 SS&C Intralinks LP Survey, general partners are listening to their investors by integrating ESG into every aspect of their funds.

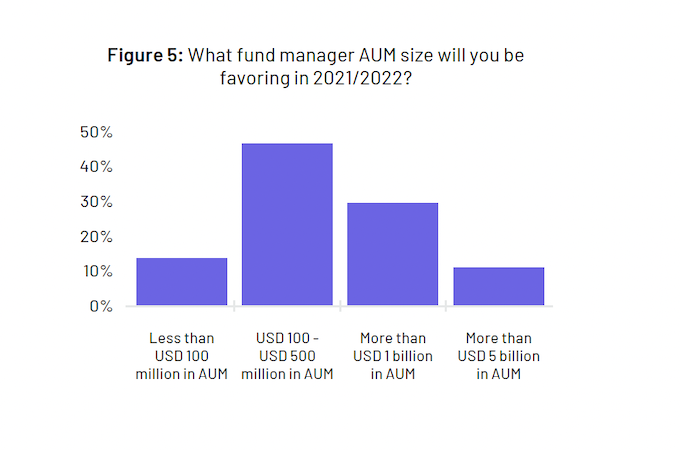

A preference toward smaller asset managers found in the 2022 SS&C Intralinks LP Survey produced in association with Private Equity Wire may indicate how considerations around impact and environmental, social and corporate governance (ESG) are picking up steam in alternative investments.

"While [general partner] GP size is a factor when it comes to investing, [the] selection is still largely governed by client strategy, which needs to be addressed on a case-by-case basis," says Tricia Ward, director for private markets at Redington, an independent investment consultancy based in the U.K.

"If anything, it may be more challenging to offer smaller, emerging managers to our clients — for instance, they may not move the needle for a large pension scheme today — but if our clients are interested in investing with an impact-lending lens, then they may need to look at smaller and emerging GP funds," she says.

According to the latest LP Survey, 43 percent of limited partners (LPs) confirmed that they preferred managers on the smaller end of the assets under management (AUM) spectrum last year — those overseeing assets between USD 100 million and USD 500 million. At the same time, one-third of investors backed managers with north of USD one billion in AUM but only one in 10 LPs backed managers with over USD five billion in AUM.

Our report, which surveyed 199 global LPs, also found that emerging managers — those with less than a three-year track record — are beginning to pique the interest of LPs attracted by high return potential, access to niche investment strategies and new talent.

"Impact lending is still a nascent asset class, so LPs interested in this will have to turn to specialist emerging fund managers,” says Ward. “But size and experience will come over time."

ESG investing

According to research by Preqin, USD 3.1 trillion of private capital assets are managed by firms that are committed to ESG investing. This is 36 percent of the total USD 8.5 trillion of private capital AUM globally.

At the same time, managers are spending more time and money on exploring solutions that respond to investors’ interest in impact investing, a direct response to the emerging climate crisis and the global shift for investment to do good.

“At Redington, our default client advice is to provide net-zero advice,” Ward says. “This means that with every opportunity we assess, we look at GPs that are genuinely aligning to net-zero and showing tangible effort to measure the real-world impact.”

Nevertheless, without any common benchmarking processes or standardized reporting around ESG, greenwashing has infiltrated the alternative assets industry — and even LPs with the best intentions may find this hard to avoid.

To gain clarity into this nascent asset class, advisors are taking reporting into their own hands, creating their own databases and monitoring systems to collect quantitative and qualitative data for clients. “We have enhanced our internal expertise and broadened the team at Redington in order to provide best-in-class services to our clients, including ESG trends," says Ward.

"It is an evolutionary process, so at first we will have to watch how GPs incorporate short-term accountability measures to achieve long-term ESG objectives. But we are keen to work with GPs who integrate ESG risk into their investment processes, including impact managers, so that we have a network of trusted GPs that our clients will want to invest with.

“This will become even more important as we transition to more green and sustainable ways of doing business," says Ward.

Commitment to ESG varies between alternatives, however. According to Preqin, private debt has the highest rate of ESG commitment of any asset class, with 49 percent of AUM committed to ESG investing, but finds its lowest rate among infrastructure managers, with 31 percent of AUM committed.

An Increasing number of GP relationships

This year’s LP Survey also reveals that over the next 12 months, more than half of LPs — 55 percent — plan on increasing the number of GP relationships they have, with only eight percent claiming that they would reduce the overall number.

The trend has emerged alongside a growing appetite for private equity (PE), and alternative assets more generally, which has flooded the market with dry powder. In 2021, private market megafunds — vehicles with pooled capital of USD five billion or more — raised more than USD 329 billion in total according to research from PitchBook.

Squared Capital, KKR and Brookfield all plan on closing fundraising for megafunds this year with Carlyle on the hunt for USD 27 billion for its latest flagship fund, making it the largest private equity vehicle ever.

The explosion of megafunds in the last few years is of some concern to asset managers, who are beginning to query the quality of investments attached to these types of funds.

"With PE funds of USD 20 billion to USD 30 billion — how does that change their strategy and investment opportunity?” says Ward. “We are concerned when clients are solely interested in looking to megafunds and recognize that there may be a gap, and hence an opportunity left behind for the somewhat ‘smaller’ managers. As such, we have to make sure that we encourage LPs to assess GPs much more holistically.

“We advise LPs to focus on strategy, look at the team and assess the company’s track record before they commit capital to a specific fund. But because the GP-LP relationship is all about longevity, it’s about so much more than those sorts of front-page headlines," she says.

According to the latest survey, six out of 10 LPs said that the single most important factor when selecting new managers was the quality of the portfolio management team, with five in 10 saying that historical performance was the second most important issue.

But the relationship is a two-way street, says Vignesh Vijayakumar, chief operating officer at Miras Management Ltd. “The quality of the LP-GP relationship remains paramount. When a GP shows discipline in terms of long-term fund management and an LP offers stable support and does not scale back deployments when markets dip, this makes for a good LP-GP relationship."

Ward agrees: "GPs need to engage, be open and transparent with LPs in regard to challenges they face and how they can improve returns. Meanwhile, LPs are encouraged to be demanding of GPs, but tolerant at the same time — and this is particularly relevant in relation to the integration of ESG."

The global pandemic and the emerging climate crisis have catalyzed our need to embrace ESG and impact investing into capital markets in order to create resilient economies moving forward. Communication between LPs and GPs will be central to successful returns as investors continue to navigate their way through this new investor landscape. All must be aware, however, that getting it right and reaping the associated benefits will take time.

Meghan McAlpine

As Sr. Director of Strategy and Product Marketing for Intralinks, Meghan McAlpine is responsible for the go-to-market strategy and driving the growth of the company’s Alternative Investments solution, the leading communication platform for private equity and hedge fund managers and investors.

Prior to joining Intralinks, Meghan worked in the Private Fund Group at Credit Suisse. While at Credit Suisse, she raised capital from institutional and high net worth investors for domestic and international private equity firms.