Syndtrak vs.

SS&C Intralinks LoanStream™

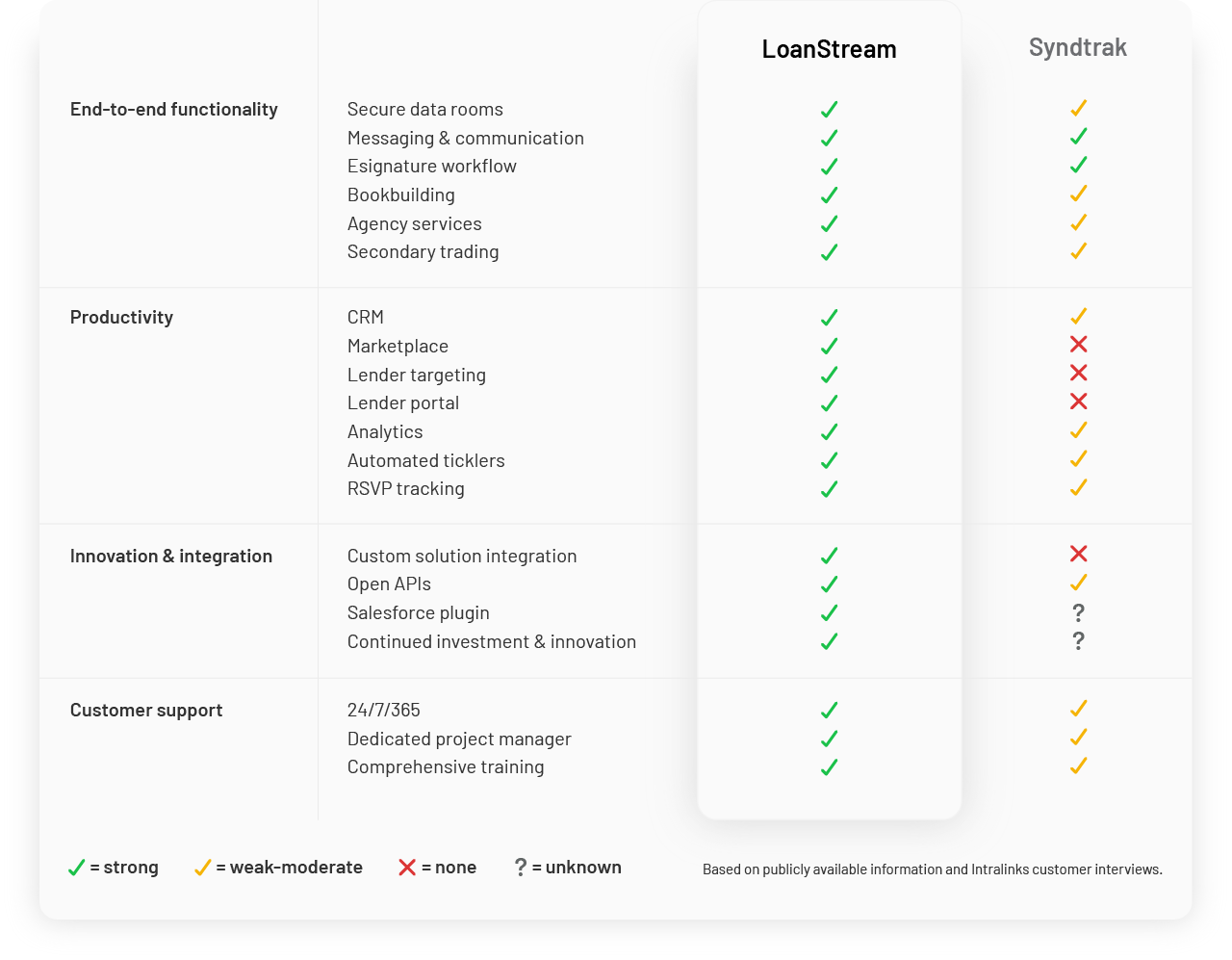

Not all providers are created equal

While there are various platforms to support your lending business, choosing Intralinks offers distinct advantages. SS&C Intralinks, the pioneer of the virtual data room (VDR), delivers continued innovation and support for all participants in the loan ecosystem.

Syndtrak

Syndtrak, a lending platform owned by FIS, offers a SaaS platform solution for loan syndication, loan servicing, deal management, bookrunning, CRM and document distribution.

While Syndtrak has been a software leader for syndicated loans, evolving customer demands have allowed more innovative solutions like Intralinks LoanStream to enter the market.

Vs.

LoanStream

- Modern, end-to-end functionality: Supports the entire loan lifecycle, including origination, syndication, reporting and secondary trading.

- Efficiency and process automation: Streamlines the syndicated loan process through customized workflows, e-signature capabilities, back office and open API integrations, and automated ticklers.

- Higher ROI: LoanStream eliminates the need for multiple systems, spreadsheets and emails, reducing time-consuming, error-prone manual and administrative tasks, while mitigating risk.

Transform your loan syndication process

Transform your loan syndication process

Benefits for originators, syndicators, lenders and agents

LoanStream is an all-new, modern and intuitive platform that brings increased efficiencies to all involved in the loan lifecycle. Read our product factsheet for more details.

FAQs

Syndtrak supports a range of syndicated deals – from middle-market club deals to larger, multi-tranche transactions. What about LoanStream?

Yes. LoanStream supports a full range of loan transactions — not just syndicated loans. Our platform also facilitates club loans, direct lending/private credit, commercial real estate, secondary loan sales, and commercial and industrial loan sales.

Syndtrak provides CRM tools for multiple parties to collaborate on transactions. Does LoanStream enhance collaboration and efficiency for these stakeholders as well?

Yes. LoanStream provides comprehensive functionality throughout the entire loan lifecycle, bringing together syndicators, lenders, agents and other participants on a centralized platform to facilitate efficient decision-making and deal closing. Stakeholder benefits include:

- Originators/arrangers/syndicators/bookrunners can sell loans based on specific lender characteristics, distribute and track diligence materials, monitor lender activity in real time and facilitate bookbuilding.

- Institutional lenders/investors can gain access to a loan marketplace and discover opportunities based on their parameters and goals. They can perform due diligence, commit to purchase a loan, and relist a loan for secondary sales.

- Agents can manage lender access to information, set up and automate ticklers, utilize white-label reporting interfaces and seamlessly integrate with back-office systems.

Our syndicated lending desk uses Syndtrak. What are the advantages of changing providers?

There are several reasons to consider a switch:

- Backed by Intralinks: As the pioneer of the best-in-class VDR for banking and capital markets, Intralinks boasts over two decades of leadership in providing solutions and services for strategic financing.

- Ongoing innovation and R&D: Intralinks invests heavily in innovative solutions for the institutional lending market. LoanStream offers a modern, intuitive user interface and end-to-end automation supporting loan origination through syndication, bookbuilding, closing, agency and secondary trading, as well as dedicated platform integration and customer support.

- Globally adopted: Intralinks is a vetted and approved technology provider used by all bulge bracket banks and can quickly deploy LoanStream for your team’s next loan syndication.