DealCentre™ for Energy

Tap unlimited power.

Charge your energy deals and keep them flowing smoothly with:

- Dedicated global service team with 25 years facilitating energy deals

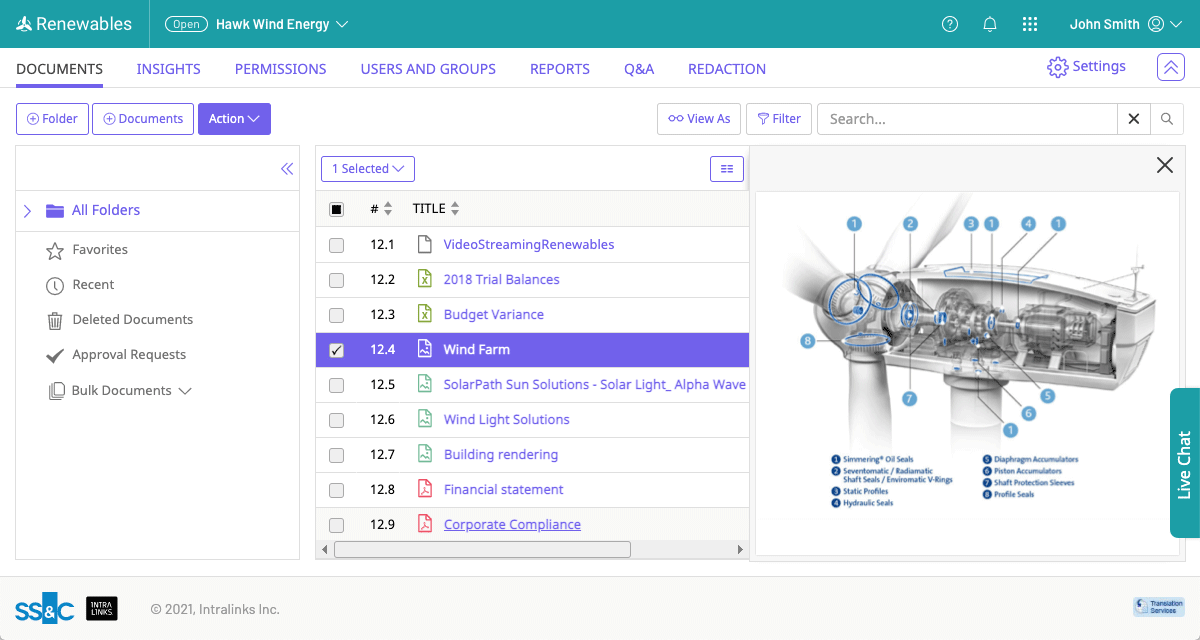

- A purpose-built solution featuring in-line CAD viewing and support for well-core logs, seismic data, surveys and maps

- Fast and intuitive virtual data room, featuring automated setup, preconfigured workflows and real-time insights

Trusted by energy companies worldwide.

Benefits

Avoid power failures.

Energy deals are complex, with resource-intensive disclosures and immense data requirements.

Use DealCentre for Energy to increase data security, automate tedious processes and streamline complex energy transactions with DealCentre’s purpose-built solutions and advanced virtual data room.

Unlimited potential energy.

DealCentre’s unique suite of purpose-built products gives you unlimited power to find the deals you want, accelerate execution and close at the highest possible value.

- Accelerate M&A due diligence with automated setup, easy file management — including bulk uploads, document-based workflows, integrated redaction

- Easily organize, accelerate and track distribution of teasers, NDAs and CIM — save time and gain insights on buyer behavior

- Organize data room documents, streamline Q&A and add clarity to decision-making with an AI-powered solution designed specifically to support M&A buy-side due diligence

Meet the Suite.

Features

Get the right answers from an experienced team

Keep deals moving even while on the go, from anywhere

Protect PII and other sensitive content – without ever leaving your virtual data room (VDR)

Share documents safely and revoke access permanently – even after download

Machine learning, enhanced analytics and content categorization

Target, track, and engage with your best buyers faster

Meet a few members of our global energy deal team.

We’re experienced in every type of energy deal – from Oil & Gas to Renewables.

Done deals. Done well.

USD 1.2 billion

USD 2.7 billion

an independent, listed oil and gas producer based in Texas, used Intralinks in its acquisition by Noble Energy for USD 2.7 billion.

USD 6.7 billion