Report: Success in Today’s Global Real Estate Environment Requires Flexibility and Fortitude

16 November 2022New PitchBook report reveals opportunities despite challenges in the sector.

An August exclusive in the Wall Street Journal reported a major, and somewhat unexpected, commercial real estate (RE) deal. Singapore-based GIC, one of the world’s largest sovereign investment funds, partnered with Workspace Property Trust to purchase a majority stake in 53 suburban U.S. office buildings. The deal placed a combined USD 1.1 billion value on those properties. This billion-dollar investment in suburban offices — rather than gleaming, city-center office towers — may have been difficult to imagine in previous years. But as SS&C Intralinks’ Global Real Estate Environment Report featuring data provided by PitchBook shows, 2022 has not been your average year.

Historically, real estate investments have been considered “safer” moves at a time when other asset classes are in flux. However, the COVID-19 pandemic dramatically changed this long-held belief, as hybrid work and other factors have shaken up both Residential and Commercial Real Estate.

Turbulent market conditions for dealmakers

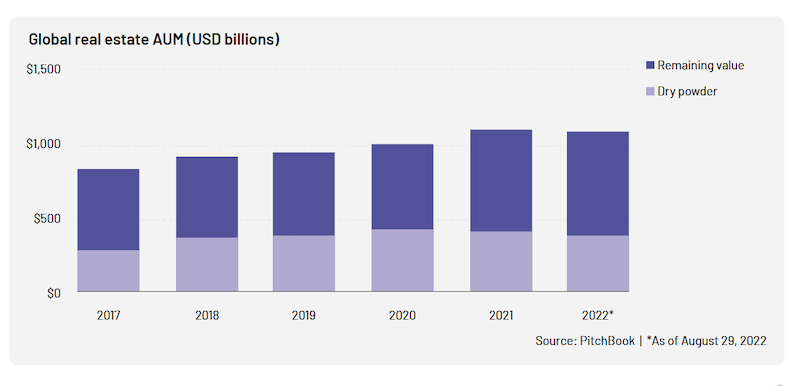

As the report shows, real estate fundraising has slowed dramatically in 2022. Investors are again grappling with challenging dealmaking conditions following vigorous growth in 2021. Last year, low interest rates drew investors back into the industry after the tumult of 2020. At the start of 2022, however, came more turbulence.

Persistent global supply-chain disruptions have continued to take a toll on planned construction projects. In several nations, inflation has reached levels not seen in decades, spurring central banks to raise interest rates. Mortgage rates have risen accordingly. Geopolitical uncertainty posed further complications as the conflict in Ukraine lingered, increasing the disruption of worldwide logistics. As a result, capital raised so far in the sector in 2022 has plummeted, amounting to just over one-third of 2021’s total.

Challenges and opportunities

It’s not all bad news, however. Yes, there has been an overall decline in short-term expectations for real estate funds, but long-term prospects remain on solid ground. Investors are still showing an appetite for risk. Opportunistic properties1 have generated a marginally higher proportion of total fundraising this year, even when accounting for the rising cost of debt. Unsurprisingly, this interest is generally found in larger firms, which benefit from economies of scale. Five of the six largest funds closed in 2022 have followed this strategy.

Even with slower fundraising in 2022, RE assets under management are still elevated overall; likely still carrying momentum from funds’ combined USD 1 trillion performance in 2021. With significant 2021 capital still available for deployment, funds can continue to deliver strong returns — if investors remain disciplined amid looming recession and ongoing economic concerns.

Looking ahead

As the rest of 2022 plays out, the most successful investors will prove to be the ones who factored flexibility into their fund strategies. Firms today must contend with tremendous uncertainty in Real Estate, an asset class once considered to be a more stable investment. Some of this uncertainty could ultimately lead to positive outcomes. As an example, the widespread transformation of property use continues to evolve. Some major cities like San Francisco are considering a transition of office properties into residential real estate, mirroring a Calgary initiative that began in 2021. While seismic shifts like these present risk, they also offer an opportunity for early-moving investors with a keen eye for future trends.

In addition, investors in residential properties will have to adjust their expectations keeping a close eye on emerging regional hotspots driven by pandemic migration. Logistics and warehouse property investments, the darlings of the pandemic e-commerce boom, will likely cool as brick-and-mortar retail nears pre-pandemic traffic levels.

All told, asset fundamentals should still anchor long-term returns and provide some insulation. Even though dealmaking conditions in Real Estate have been more complicated in 2022, and despite fundraising levels taking a significant trim, Real Estate's long-term viability remains favorable for those with patience and reasonable expectations.

To read the full report, click here.

1 Opportunistic investments tend to be made in properties that require substantial additive efforts due to a need for renovation, repurposing, high vacancy rates, or shifting supply-demand dynamics in a market. This category also includes new property development such as greenfield and brownfield projects.

Related Content

Meghan McAlpine

As Sr. Director of Strategy and Product Marketing for Intralinks, Meghan McAlpine is responsible for the go-to-market strategy and driving the growth of the company’s Alternative Investments solution, the leading communication platform for private equity and hedge fund managers and investors.

Prior to joining Intralinks, Meghan worked in the Private Fund Group at Credit Suisse. While at Credit Suisse, she raised capital from institutional and high net worth investors for domestic and international private equity firms.