The Future of M&A: How AI Will Shape the M&A Deal Process

28 February 2024Key milestones in the M&A lifecycle such as due diligence and target identification will be optimized by artificial intelligence, while allowing dealmakers to focus more on areas such as negotiation and stakeholder communication.

In the dynamic world of mergers and acquisitions (M&A), the emergence of artificial intelligence (AI) — including big data, machine learning (ML), large language models (LMMs) and other tools — are set to revolutionize the industry.

The world of M&A is changing. No longer just supplementary tools, these technologies are becoming central to how M&A strategies are crafted and executed.

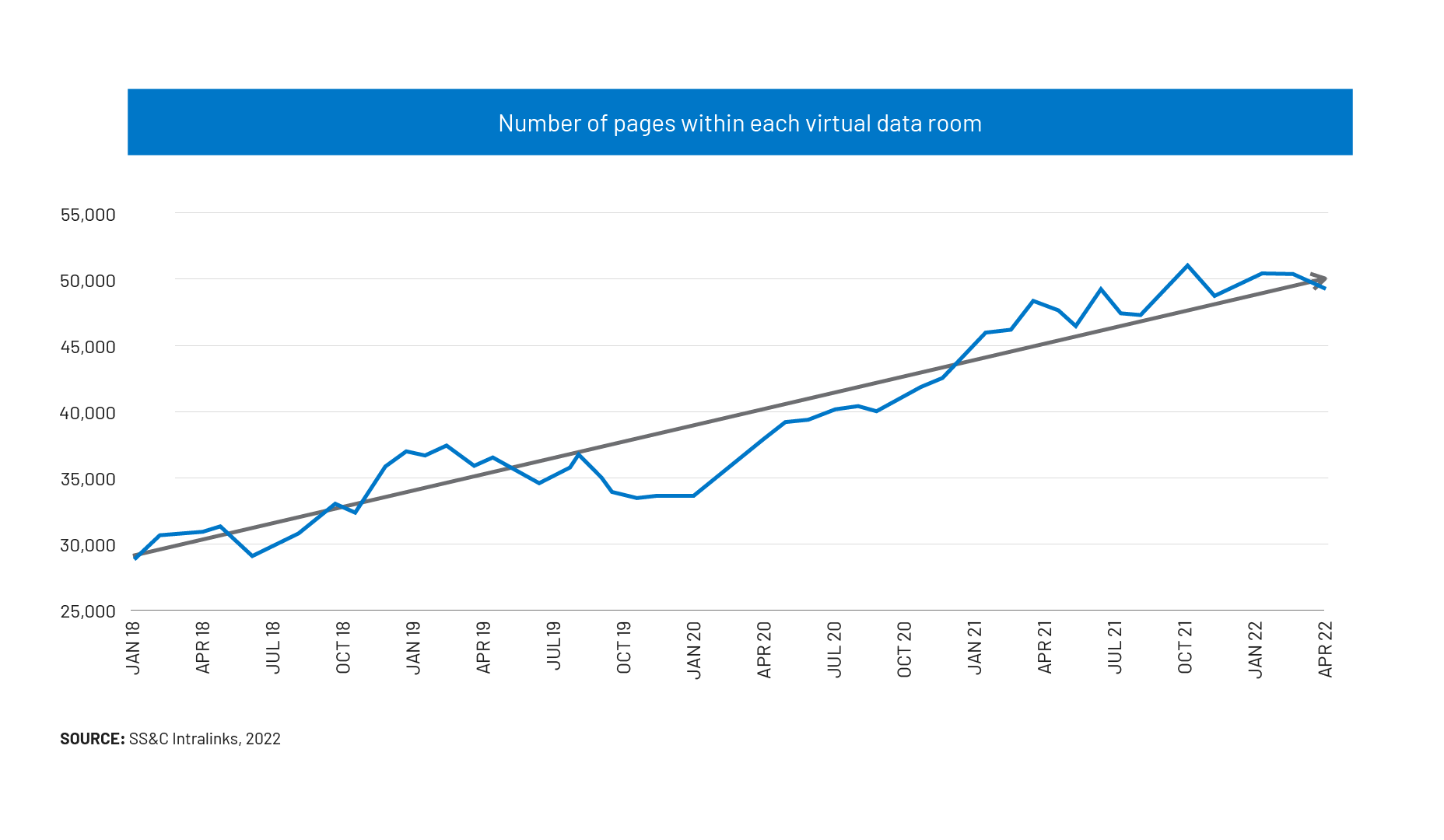

Data from SS&C Intralinks showed that even well before the global pandemic of 2020-2021, the amount of data provided for each deal was rapidly increasing, making it virtually impossible for human interaction alone to synthesize and understand the complexities of target companies.

This truly is the era of big data. Using AI techniques to navigate this new data-driven world will not be a “nice to have,” but rather a “need to have.”

Where will the impact be greatest across various stages of the M&A process?

We can answer this question by drawing on insights from the recently published The Deal Paradox: Mergers and Acquisitions Success in the Age of Digital Transformation by Driessen, Faelten and Moeller (Kogan Page, 2023), which includes interviews with numerous industry experts both within AI and across the M&A deal process.

The Impact of AI on M&A

1. Strategy: Deciding Whether to Pursue M&A

AI and big data are reshaping strategic decision-making in M&A. By analyzing market trends, competitor strategies and historical deal outcomes, these technologies provide a more data-driven approach to determining whether an M&A deal should be pursued.

Over the next few years, this area will see significant impact as AI models become more sophisticated in predicting market movements and identifying strategic growth opportunities.

2. Target Company Identification

One of the most transformed areas will be the identification of potential targets. AI algorithms, empowered by big data, can sift through vast amounts of information to identify companies that match specific strategic and financial criteria.

This process is made more efficient and effective, allowing for the discovery of opportunities that might have been overlooked using traditional methods.

3. Role of Advisors

The use of expert advisors, such as investment bankers, lawyers and accountants, is an integral part of the M&A process. AI and automation will impact this area by augmenting the capabilities of advisors.

For example, AI can assist in complex financial modeling or legal document review (which are already undergoing trials in some organizations) and will have a major impact on the way these advisors run their business.

4. Negotiation

Negotiation in M&A is a nuanced process heavily reliant on human judgment and interpersonal skills, colored by emotion. AI can support this process by providing detailed analysis of previous deals and market conditions, but the core of negotiation will remain less affected by AI, maintaining a strong human-centric approach.

This reflects the paradox from the book noted above, as the human element may play a greater role in the process while the AI manages more specific activities as noted above and below.

5. Due Diligence

The use of virtual data rooms (VDRs) and the amount of data stored in those VDRs has transformed the due diligence industry for the past 20+ years, and more recently as shown in the chart above.

AI and ML, with their capabilities in analyzing large datasets, can conduct thorough due diligence at a speed and depth unattainable by human teams. This includes financial analysis, risk assessment and even assessing cultural fit between companies. Natural language processing (NLP) algorithms can extract key information from documents, making it easier for teams to identify risks and opportunities.

This area will continue to see one of the highest impacts from AI and automation.

6. Valuation and Pricing

Valuation is another area where AI and ML will have a profound impact. These technologies enable more accurate and dynamic valuations by analyzing a multitude of factors such as market conditions, company performance, competitive response and future growth projections.

AI-driven models can also continuously update valuations in real-time, a significant advantage over traditional methods.

7. Communication

Effective communication is crucial in M&A transactions, both internally with the merging companies and externally with key stakeholders.

While AI can aid in the analysis of communication strategies and stakeholder sentiments, the actual process of communicating will remain less influenced by AI. The personal touch and understanding of human emotions in communication are aspects that AI cannot yet fully replicate.

8. Post-Merger Integration

One of the biggest challenges in M&A is the integration of two organizations. AI-powered project management tools can help streamline this process by identifying key milestones, tracking progress and ensuring that both companies' cultures are aligned for a smooth transition.

Post-merger integration (PMI) is the “make or break” phase in the M&A deal process and one where true success is determined. M&A practitioners should use more AI at this stage of the deal, but sadly they don’t … yet.

Conclusion

The future of M&A is intrinsically linked with the advancements in AI. While areas like due diligence, valuation and target identification will be profoundly impacted, aspects such as negotiation and stakeholder communication are likely to see less disruption.

As highlighted in The Deal Paradox, the successful integration of these technologies in M&A requires not just technological adoption but also a strategic shift in thinking. The firms that can effectively harness these technologies will gain a significant competitive advantage in the ever-evolving landscape of M&A.

* * * * * * *

To gain additional insights into the sentiments of leading U.S. dealmakers on artificial intelligence in dealmaking, read our white paper, Charting the AI Course.

To learn more about SS&C Intralinks’ AI capabilities, click here.

Related Content

Professor Scott Moeller

Professor Moeller works closely on a number of research projects with SS&C Intralinks. He is the author or co-author of seven books on M&A, including his most recent book referenced in the article above about the trends in the use of advanced technologies in M&A and private equity deals. Prior to his move into academia, Scott was a senior executive at Deutsche Bank and Morgan Stanley in New York, Tokyo, Frankfurt and London.