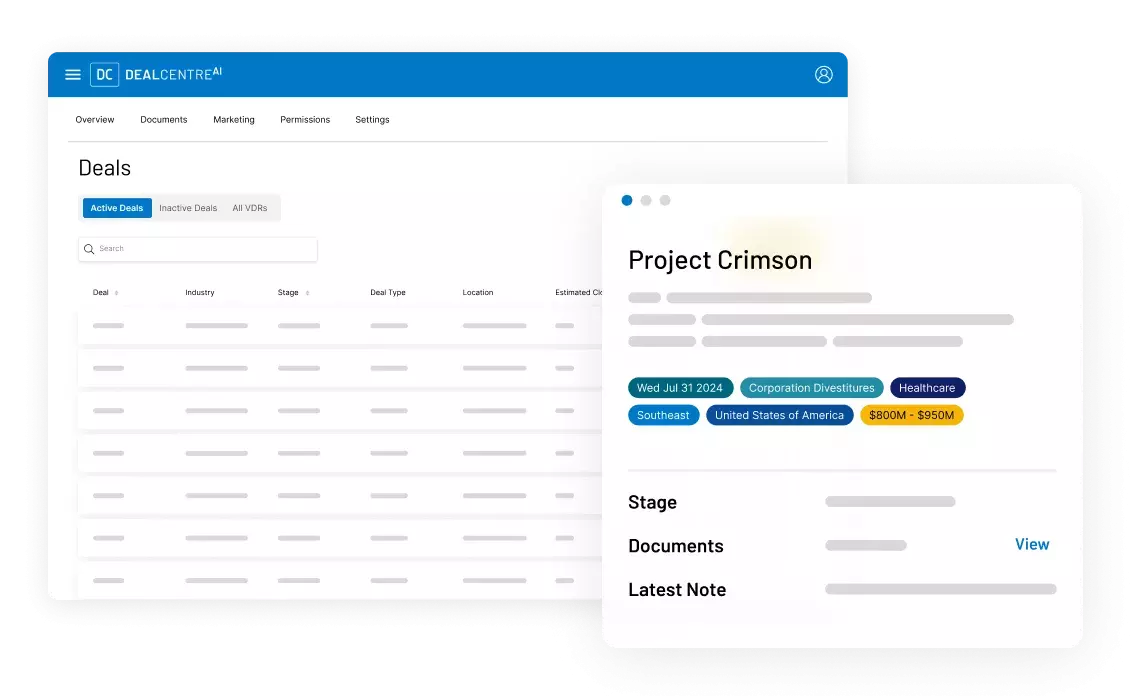

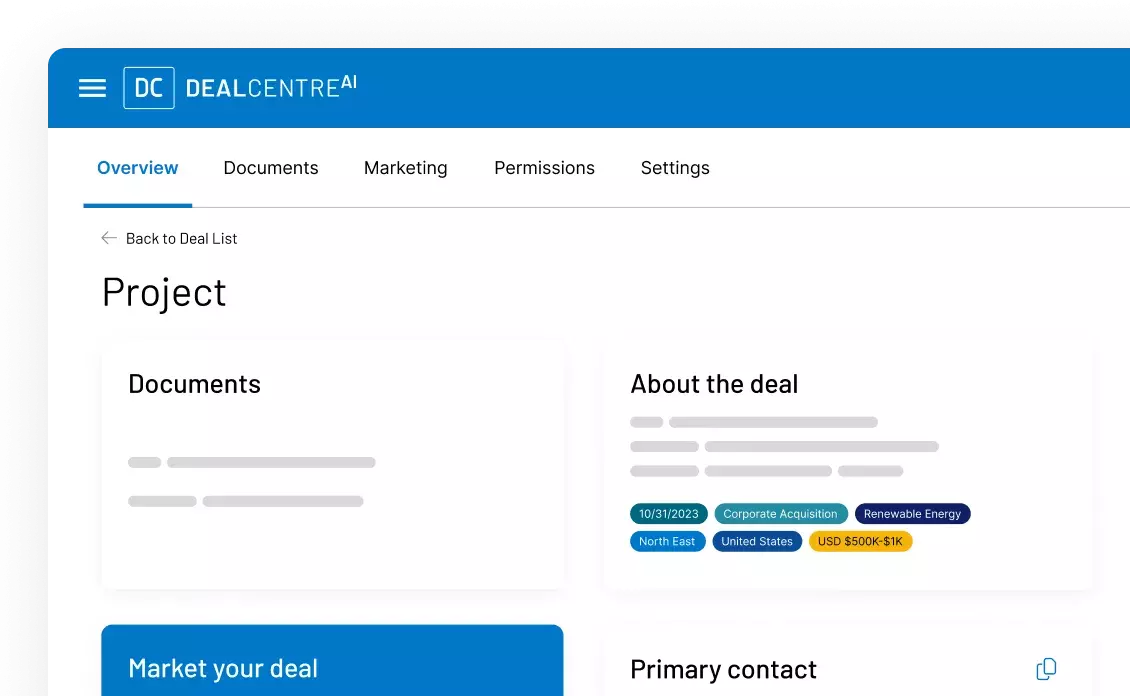

Deal management,

simplified

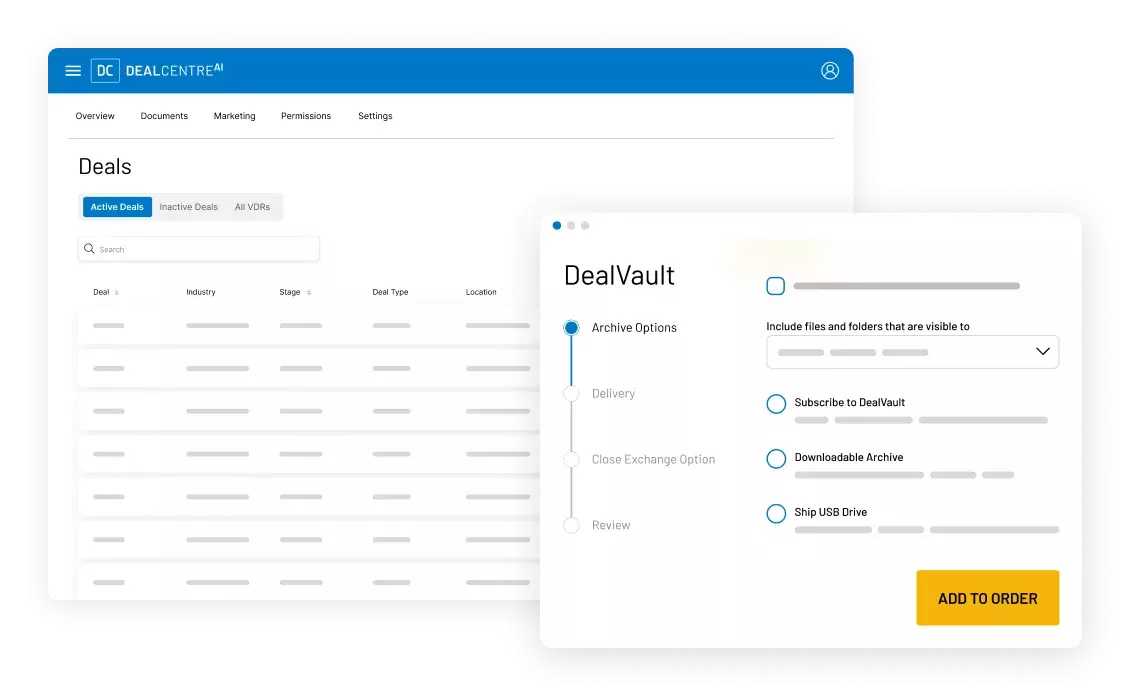

Whether actively engaged on a deal or preparing your pitch, maintaining deal momentum is critical to deal success. Manage all your M&A transactions at every phase using the centralized control capabilities within DealCentre AI and keep your deal moving toward the finish line.

DealCentre AI resources