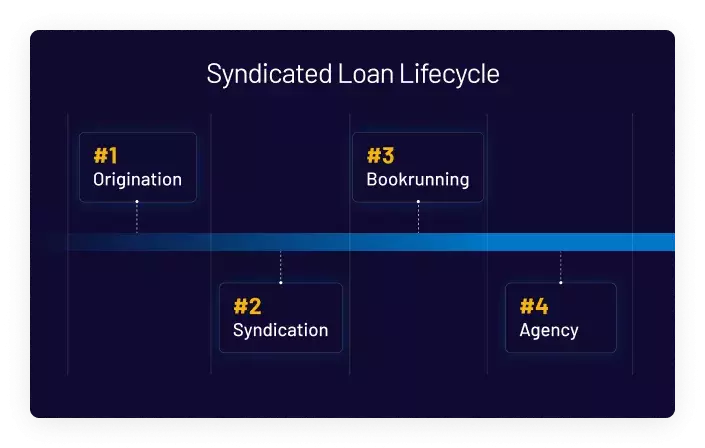

Streamline the entire

syndicated loan lifecycle.

Relying on a combination of manual methods and multiple platforms for loan syndication is time-consuming and unsecure. SS&C Intralinks streamlines and automates the entire loan life cycle.

End-to-end process automation

From origination to closing and agency reporting, Intralinks’

intuitive, automated solution covers the entire loan lifecycle

and ecosystem.

Bookbuilding

Efficiently manage and track lender commitments, real-time

order status, and allocations by tranche and pricing.

Integration and open APIs

Easily integrate with existing platforms, eliminating the need

for manual data entry and disparate systems.