The smart choice

for M&A dealmaking

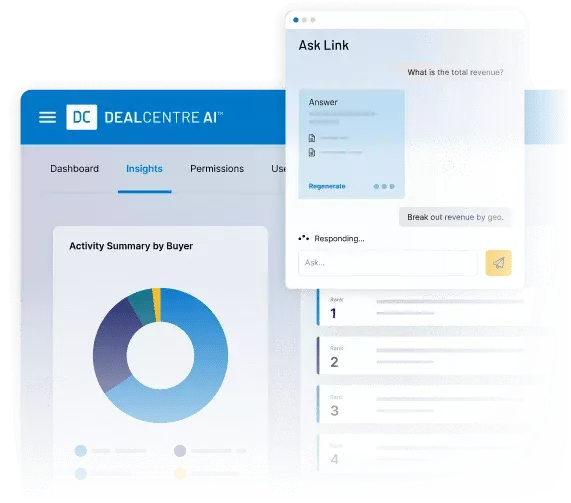

DealCentre AI is the first intuitive dealmaking solution for every phase of your deal. Powered by Link, our AI engine, DealCentre AI gives you an extra edge, enabling you to work faster and tackle every deal pain point.

AI-powered deal intelligence

DILIGENCE

Achieve better outcomes with AI-driven deal intelligence.

- Streamline deals on a single platform

- Keep deal timelines on track with greater visibility

- Accelerate discovery and speed diligence with Ask Link

- Uncover insights to optimize future diligence efforts

PREPARATION

Stay organized at every step on a single platform with integrated AI.

- Gather files easily and securely with the Document Request Link

- Track progress of requested documents in real-time

- Quickly pinpoint and address problematic files

- Self-launch deal prep rooms to save time

MARKETING

Automate buyer outreach and engagement to generate interest.

- Create outreach phases, customize lists

- Store and reuse past data

- Track activity and gain prospect insights

- Transition seamlessly to diligence

MANAGEMENT

Maintain control and stay on track throughout the entire deal.

- View all deals in one place — from ideation to close

- Quickly create new deals with self-service capabilities

- Launch or link to live rooms directly from the deal

- Access past deal records to drive greater insights

AI security approach

How long has Intralinks been developing AI solutions?

In 2018, we began investing in developing of our own proprietary AI infrastructure and solutions.

FLIP TO ANSWER

Does Intralinks use ChatGPT? Does Intralinks partner with an external party?

No. Having invested in developing organic AI solutions for over five years, we do not rely on or ship data to third-party providers.

FLIP TO ANSWER

What large language models (LLMs) does Intralinks use?

We manage several of our own LLMs, ensuring that customer data never leaves the virtual data room (VDR). Additionally, we rigorously enforce our strict security practices regarding data tenancy

FLIP TO ANSWER

How does Intralinks Manage data security and privacy?

We curate several of our own models, and customer data never leaves our environment. Our strict, multi-layer customer data security practices are continually enforced.

FLIP TO ANSWER

Is my information viewable to other Intralinks customers?

We have implemented safeguards to ensure that models only respond to content a customer has access to. This eliminates the possibility of another customer viewing your information.

FLIP TO ANSWER

How does Intralinks train their AI models?

We use various generally accepted methods to enhance the models we select, including techniques like few-shot learning and reinforcement learning.

FLIP TO ANSWER

Do the Intralinks models get better over time?

Yes. Thanks to a variety of methods we deploy along with ongoing technological advancements, the models are designed to continually improve over time.

FLIP TO ANSWER

Does Intralinks use my data to train, re-train or improve your AI models?

No, we never use any customer data to train, re-train or improve our models. Your data is always safe and protected within our ecosystem.

FLIP TO ANSWER

How many models does Intralinks use? How does Intralinks select models?

We deploy a constellation of models. Each model is selected for a specific purpose on our platform. The selection process starts with a benchmark study for proof of efficacy in our lab environment before proceeding to further, more in-depth training.

FLIP TO ANSWER

How does DealCentre AI compare?

| Feature | DealCentre AITM | Primary VDR Competitor |

|---|---|---|

| First purpose-built, end-to-end AI-powered platform for dealmaking | ||

| Manage every phase of the deal lifecycle within a single unified platform | ||

| Maintain complete visibility of all deals in your pipeline, from inception to close | ||

| Launch deals in minutes with self-launch Deal Prep | ||

| Easily identify and remove duplicative tasks in-platform to save time | ||

| Activate Marketing directly within DealCentre AI for seamless buyer outreach | ||

| Perform in-app conversion to PDF | ||

| Run Document Analyzer tool to quickly identify password-protected docs | ||

| Manage buy-side checklists | ||

| Easily maintain internal notes, documents and tasks related to your deal | ||

| Harness a suite of AI-enabled document features, including document categorization, summarization, keyword extraction, PII identification and translation | ||

| Engage with our generative AI solution to ask specific questions and speed your deal process | ||

| Store and access data from past deals performed within the platform | ||

| Leverage AI-driven analytics and insights from previous deals to guide future activity | ||

| Optimize team resources with end-to-end deal transparency | ||

| Easily share critical information between deal members directly within the platform | ||

| Simplified permission management and client document collection capabilities | ||

| First provider to secure ISO 27701 certification, the highest standard of data privacy | ||

| Incorporates cutting-edge AI innovations resulting from over $200M in R&D investments since 2018 | ||

| Backed by SS&C Technologies, the world’s largest alternative asset administrator and global fintech leader | ||

| See More | ||

| See Less | ||

The new reality: AI and dealmaking

View Transcript

Q: Ronjohn, welcome back. Since we last spoke a year ago, what’s changed in the world of AI and dealmaking?

A: A lot has changed. Last year, we were mostly talking about AI in theoretical terms—people were exploring and trying to understand how to use it. But over the past year, we've seen a shift from exploration to true acceptance and implementation. Major financial institutions now have full teams dedicated to figuring out how to integrate AI into their workflows. The speed of adoption has been surprising. Unlike the gradual shift from physical documents to the cloud, AI has been adopted and implemented rapidly, with firms now realizing its value and putting it to work in real scenarios.

Q: Some people argue AI is a solution looking for a problem. What real dealmaking pain points is AI solving today?

A: That’s a fair critique for some technologies, but in the case of dealmaking, AI is solving significant problems—especially around document and information analysis. Deals take time because of the sheer volume of information that must be reviewed. AI started by helping summarize documents but has quickly evolved to analyzing information and generating insights that would otherwise take months to uncover. It now goes a step further by recommending decisions or highlighting areas to explore, saving time and improving the quality of decisions.

Q: For dealmakers who are still hesitant or overwhelmed, what are some tangible first steps they can take to adopt AI?

A: The first step isn’t to look for AI tools—it’s to look inward. Evaluate all internal processes and identify where inefficiencies lie. This means mapping out the entire dealmaking process from start to finish and pinpointing areas that consume the most time or resources. Once you understand your operational landscape, you can then start looking for AI solutions that target those specific gaps.

But don’t stop there—when testing AI tools, ensure they can be implemented at scale and within existing workflows. A tool that works in isolation but disrupts your system can create more problems than it solves. Integration and scalability are key to successful AI adoption.

Q: Any final thoughts on how you see AI continuing to evolve in dealmaking?

A: It’s an exciting journey. AI is already transforming how deals are processed by enhancing speed, accuracy, and decision-making. As more people adopt and experiment with these tools—and do so in a structured, strategic way—I believe we’ll uncover even more impactful use cases in the near future.

Dedicated customer service

A single point of contact who knows your business and your deal, backed by a global team supplying expert guidance.

Client assist team

We do the heavy lifting — from setup through closing — so you can focus on the deal.

Bespoke service options

Get the level of support you need — from online, on- demand response to complete, tailored service team integrations.

After-hours support

Global, comprehensive support no matter where you are or how late you’re working.

Elevate your deals

with the power of AI

Collaborate and close deals faster than humanly possible. Discover the AI-powered platform built to help your team win.

Dig into the details

Industry-Specific Solutions

DealCentre AI provides tailored functionality to support the unique needs of different industries. For example, in healthcare, the platform ensures compliance with strict regulatory frameworks while facilitating secure exchange of sensitive patient data. For financial services, DealCentre AI helps manage large-scale mergers involving complex asset portfolios, offering precise analytics to guide critical decision-making. Similarly, in real estate, the platform streamlines property transactions through intuitive data visualization tools and collaborative features.

By addressing the distinct challenges faced by various sectors, DealCentre AI ensures users get specialized tools and insights to meet their objectives. Whether it’s navigating stringent regulations, managing stakeholder communication, or evaluating asset performance, the platform is designed to adapt. This industry-specific approach minimizes inefficiencies while maximizing deal success.

Post-Merger Integration

The post-merger phase often presents a complex set of tasks, from integrating organizational workflows to aligning operational goals. DealCentre AI simplifies this process, providing tools that help identify synergies, track integration milestones, and ensure accountability across teams. The platform centralizes critical information, enabling all stakeholders to stay aligned and informed throughout integration.

Detailed dashboards make it easy to monitor progress, providing insights into key performance indicators like cost savings and operational efficiency improvements. With DealCentre AI, teams can foresee and mitigate risks during this challenging phase while ensuring that integration leads to sustainable long-term benefits for the combined entity.

Third-Party Integrations

Efficient collaboration often depends on the ability to connect with tools already in use. DealCentre AI integrates seamlessly with industry-standard platforms like Salesforce, Slack, and Microsoft Teams, ensuring that deal teams can work without disruption. The platform supports data flows across CRM systems, project management tools, and secure file repositories, creating a cohesive digital ecosystem.

By eliminating data silos, these integrations allow users to track progress, share updates, and access information in real-time. Whether preparing reports, managing client relationships, or coordinating with external advisors, DealCentre AI’s integration capabilities simplify every step of the M&A lifecycle.

Advisory and Collaboration Tools

M&A success relies on effective collaboration between advisors, teams, and stakeholders. DealCentre AI offers a suite of tools designed to enhance communication and streamline workflows. From secure messaging features that allow for confidential discussions to shared workspaces where teams can collaborate on live documents, the platform empowers users to work effectively across geographies and time zones.

These tools promote transparency, ensure accountability, and foster precision in decision-making. Advisors can access all necessary deal documents in one centralized hub, reducing dependency on email chains or fragmented communication channels. By investing in collaboration, DealCentre AI helps dealmakers stay proactive and agile.

Marketplace and Networking Features

DealCentre AI supports dealmakers by acting as more than just a platform but as a connection hub. With networking tools that match buyers, sellers, and advisors based on shared goals, it simplifies the process of identifying potential partners. Users can list opportunities, browse deals, and initiate conversations securely through the platform.

The intelligent deal matchmaking capabilities help businesses discover the right opportunities faster while ensuring confidentiality. This marketplace-style functionality turns the platform into a dynamic space for discovery, fostering valuable collaborations that would otherwise go unnoticed.

Customizable Workflows and Dashboards

Every organization runs its deals differently. DealCentre AI allows teams to build workflows tailored to their specific requirements. From automated approval processes to resource allocation tracking, users can adapt the platform to align with their preferred methodologies.

Customizable dashboards provide actionable insights at a glance, helping users track deal performance and identify bottlenecks. This adaptability makes it suitable for firms across industries and scales, ensuring that every user gets a personalized experience.

ROI and Impact Metrics

Understanding the value brought by a solution is crucial. DealCentre AI integrates tools that track ROI and impact metrics throughout the deal lifecycle. Whether it’s calculating time savings from task automation or measuring team productivity, the platform delivers quantifiable insights that highlight its effectiveness.

Reports can break down cost benefits, show operational synergies realized post-merger, or analyze the timeframes of closed deals. These metrics don’t just validate the platform’s worth but also empower teams to optimize their strategies moving forward.

Pricing and Plans

DealCentre AI offers tiered pricing plans that cater to organizations of all sizes. From smaller teams seeking to streamline their workflows to enterprise-level corporations requiring comprehensive support for large-scale deals, the platform provides flexible solutions.

By presenting a clear breakdown of features and pricing upfront, DealCentre AI ensures transparency, allowing organizations to choose a plan that fits their needs and budget. Additional customized packages can be tailored for organizations with specific requirements.

Content Automation

Repetitive tasks such as document redaction, data upload, and report generation are significantly streamlined through DealCentre AI’s automation tools. By handling these tedious processes for users, the platform allows deal teams to focus on tasks that require human oversight and creativity.

This automation not only saves time but also ensures greater accuracy, reducing the risk of human error in critical M&A documentation processes.

Through a rigorous selection process and validation within our lab environments, we routinely achieve accuracy rates exceeding over 95 percent. However, due to the inherently non-deterministic nature of artificial intelligence compared to traditional software, the learning aspect of our models ensures they are continuously evolving for the better.