While the James Webb Space Telescope beams us back incredible pictures of far-off galaxies, here on earth, private market activity appears headed for a splashdown. Moreover, high-growth moonshot investments are back in the hangar, awaiting better weather. When it comes to private equity (PE) dealmaking, 2022 stands in stark contrast to 2021.

How did we get here and where is it all going? The new report from SS&C Intralinks using data from Pitchbook, Private Equity Dealmaking: Changing Market Conditions Present New Challenges and Opportunities, offers some insights. The report examines specific trends in PE dealmaking, including cross-border investment activity and the industry’s response to changing market conditions.

According to research based on Pitchbook data, a variety of converging factors have shaped the current environment. Public markets are experiencing increased pressure as global firms readjust to new norms. Along with decades-high inflation, supply-chain disruptions continue to plague companies in almost every industry further dampening consumer confidence. Rising interest rates and the climbing value of the U.S. dollar add other layers of uncertainty, as firms outside of the U.S. must reconsider the valuations of American companies.

All told, deal sizes are unlikely to grow as quickly as they did in 2021. While median deal sizes in 2022 remain robust, smaller deals may be on the horizon in many cases. For example, some target companies could lose bargaining power if the combined pressures of supply-chain bottlenecks, inflation and recession fears slow growth and drive valuations through the floor.

Positive venture capital (VC) sentiment has declined, certainly, and put the kibosh on investments in high-risk, high-growth, profit-eschewing companies — those most favored in recent years by private investors for their big returns. Private equity firms — especially those that facilitated lucrative exits in 2021 — are now flush with cash and can score big if they deploy their record cache of dry powder. Buyouts and leveraged buyouts are the go-to strategies for these firms now. Those that can secure smart buyouts at lower prices may drive exponential returns when markets rebound. Dealmaking opportunities abound as stock performances falter and other sources of funding become harder to tap. PE firms are strongly positioned to bolster companies that have seen their valuations drop.

Cautious optimism

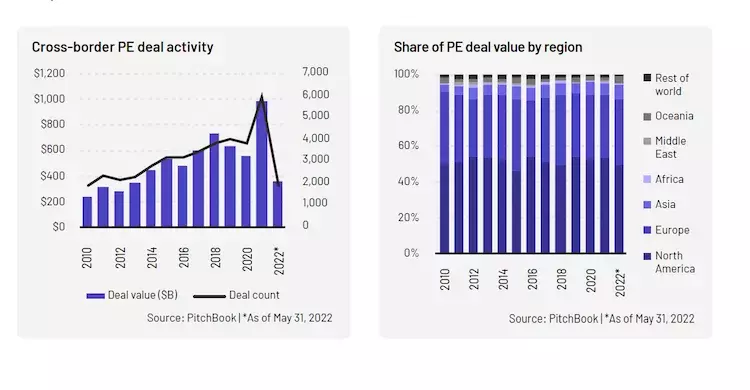

Cross-border activity will also see renewed attention in the second half of the year. Following a tumultuous 2020, cross-border activity rebounded handily in 2021. While we can expect 2022 activity to fall short, there still appears to be robust confidence between certain regions. According to PitchBook data, investments by North American and Asia Pacific firms in each other’s regions are currently trending ahead of 2021, which was a record year.

The next two quarters will likely bring further disruption. Higher interest rates, recession anxieties and supply-chain hurdles continue to strangle corporate growth and chip away at values that were sky-high just last year.

Ultimately, we expect the smartest dealmakers to take advantage of this environment — either in their regions or on other shores. They’ll set their sights a little lower on the horizon for the remainder of 2022, but that may be just where the brightest stars shine.