How can a VDR help manage real estate deals?

A virtual data room (VDR) in real estate is a secure online platform dealmakers use to manage, share, and store confidential documents throughout complex property transactions. Whether it’s commercial acquisitions, joint ventures, portfolio sales or lease negotiations, VDRs streamline the due diligence process by centralizing all necessary files — such as title deeds, zoning permits, lease agreements, and financial records — into a single, easily accessible location. This centralized access allows buyers, sellers, brokers and legal teams to collaborate efficiently while ensuring that sensitive data is protected through advanced security features like watermarking, encryption and role-based access controls.

Intralinks offers a purpose-built VDR solution for real estate professionals that delivers reliability, scalability and industry-specific tools. Designed to support high-stakes transactions, Intralinks provides seamless document organization, AI-powered insights and real-time activity tracking to accelerate deal timelines and reduce risk. Its global reach and robust compliance standards make it especially well-suited for cross-border and institutional real estate deals.

Need to advise your client

on how to choose a VDR?

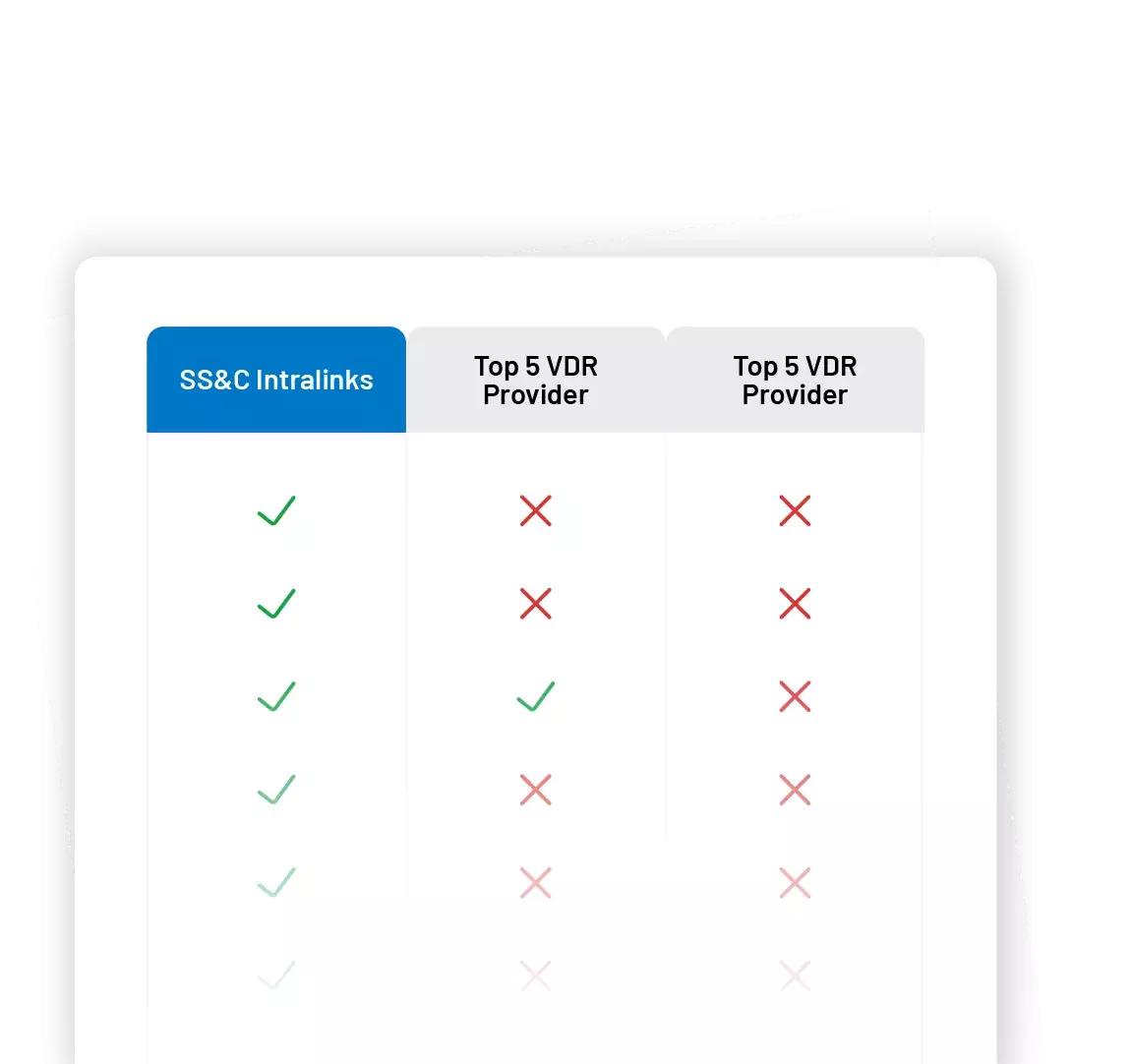

Advisors often need to present their clients with a comparison of VDR alternatives. To save you time, we built a template that includes a feature comparison between top VDR providers.