Intralinks history

As part of SS&C Technologies, Intralinks has a 35-year history of innovative, future-ready, global data-sharing solutions and services that power our clients' success.

Our values

Commitment to Customers

Winning business is the first step. Winning our customers' trust by helping them succeed is our key success metric.

People

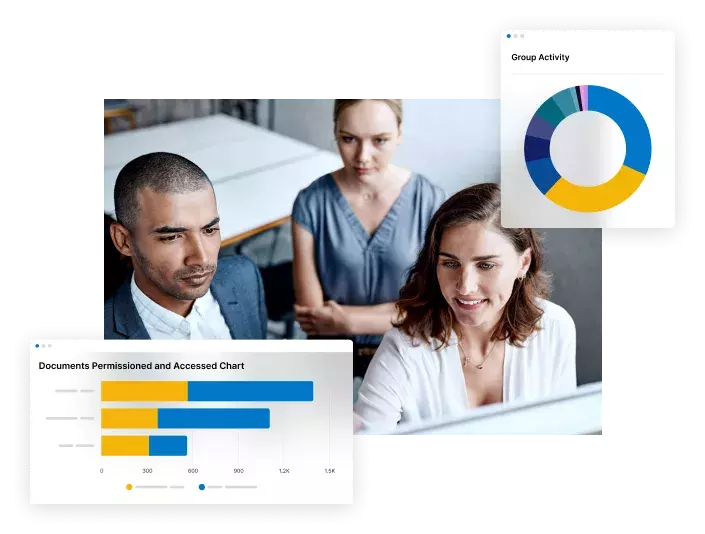

Our people are our most important assets, and actual user experience is the guiding principle behind our product designs, platform innovations, and service offerings.

Innovation

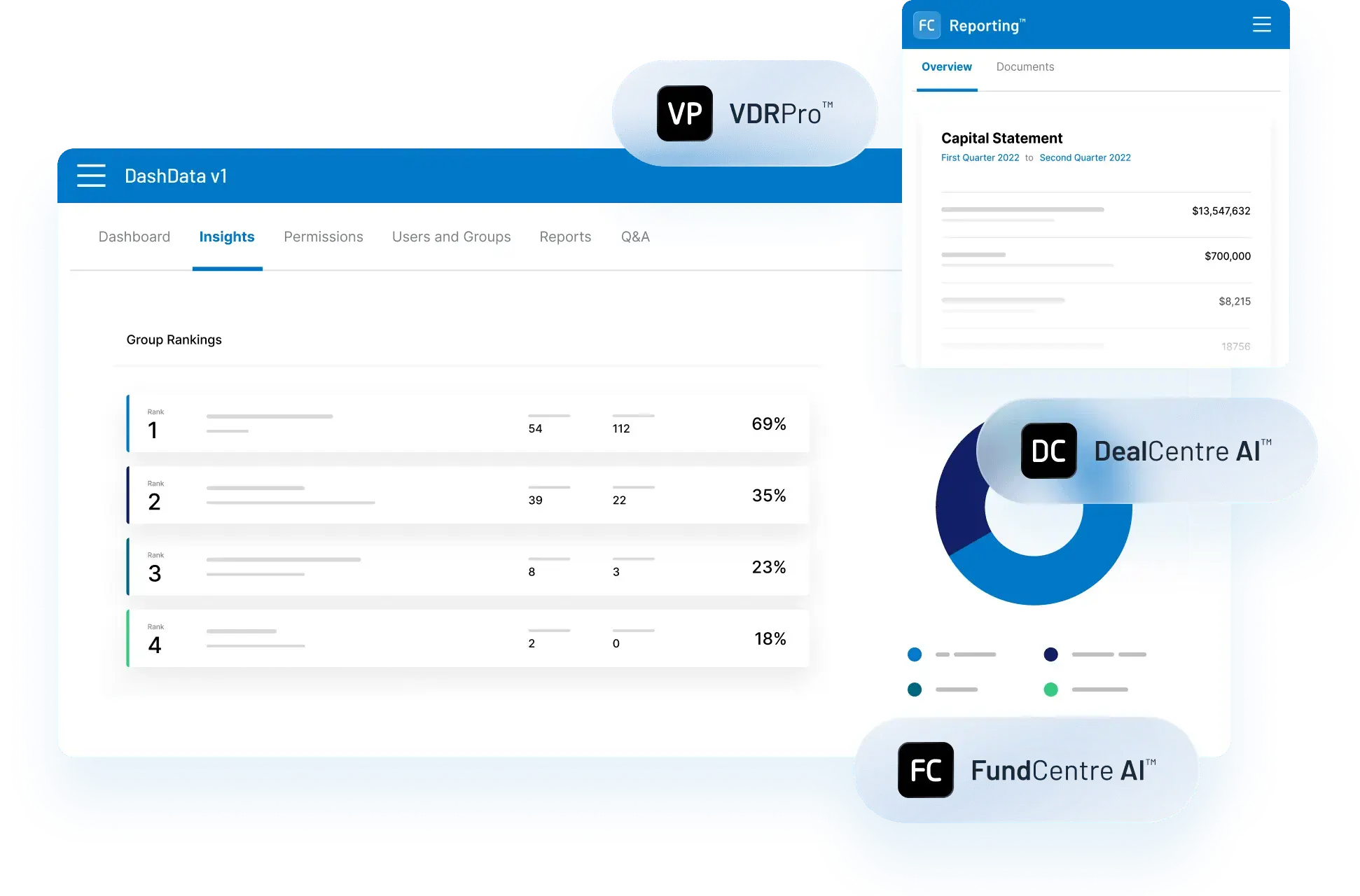

Innovation is our daily mantra. It is the key driver, the key metric, the core of Intralinks.

Integrity

We do not only do what's best for our customers. We do what's right for them.

Excellence

Excellence is not a goal, it's a process.

AMERICAS

Ciudad de México

Torrey Virreyes, Pedregal 24

Piso 2, Molino del Rey

Miguel Hidalgo, CP 11000

Tel: +52 (5) 570032350

Torrey Virreyes, Pedregal 24

Piso 2, Molino del Rey

Miguel Hidalgo, CP 11000

Tel: +52 (5) 570032350

São Paulo

Rua Ministro Jesuíno Cardoso,454 – Conj.81 - 8º Andar – Itaim Bibi

04544-051 São Paulo SP Brasil

Tel: +55 11 4560 8980

Rua Ministro Jesuíno Cardoso,454 – Conj.81 - 8º Andar – Itaim Bibi

04544-051 São Paulo SP Brasil

Tel: +55 11 4560 8980

ASIA PACIFIC

Beijing

20/F, Raffles City Beijing Office Tower

No.1 Dongzhimen South Avenue,

Dongcheng District,

Beijing 100007, P.R.China

Tel: +86 10 6406 2666

Fax: +86 10 8409 4566

20/F, Raffles City Beijing Office Tower

No.1 Dongzhimen South Avenue,

Dongcheng District,

Beijing 100007, P.R.China

Tel: +86 10 6406 2666

Fax: +86 10 8409 4566

Hyderabad

Level 4, Phase 2.3, Sy No. 115 (Part 1), WaveRock TSIIC IT/ITES SEZ,

Nanakramguda, Serilingampally,

Hyderabad, Telangana, 500008

Tel: +914049750000

Level 4, Phase 2.3, Sy No. 115 (Part 1), WaveRock TSIIC IT/ITES SEZ,

Nanakramguda, Serilingampally,

Hyderabad, Telangana, 500008

Tel: +914049750000

Mumbai

We Work BKC

13th Floor, B Wing, C-20, G Block,

Bandra Kurla Complex, Mumbai - 400051

Tel: +91 9820792333

We Work BKC

13th Floor, B Wing, C-20, G Block,

Bandra Kurla Complex, Mumbai - 400051

Tel: +91 9820792333

Shanghai

Unit 111, F/15

Hang Seng Bank Tower No.1000 Lujiazui Ring Road

Pudong Shanghai, 200120

Tel: +86 18621563080

Unit 111, F/15

Hang Seng Bank Tower No.1000 Lujiazui Ring Road

Pudong Shanghai, 200120

Tel: +86 18621563080

EUROPE

Bucharest

28-30 Academiei Street

1st District, 7th Floor

Romania 010016

Carmen Ginjulete (Office Manager): +40 726 034 034

28-30 Academiei Street

1st District, 7th Floor

Romania 010016

Carmen Ginjulete (Office Manager): +40 726 034 034

Budapest

Tel: +36 20 230 0672

Tel: +36 20 230 0672

Greece

Tel: +30 694 5893598

Tel: +30 694 5893598

MIDDLE EAST & AFRICA

Dubai

Dubai International Financial Center

Gate Village Building 10,

Level 7 - Office 10,

PO Box 506643

Dubai, UAE

Tel: +971 52 7133740

Dubai International Financial Center

Gate Village Building 10,

Level 7 - Office 10,

PO Box 506643

Dubai, UAE

Tel: +971 52 7133740

Johannesburg

Tel: +27 83 661-8409

Tel: +27 83 661-8409

Lagos

Tel: +234 803 301 9519

Tel: +234 803 301 9519

Tel Aviv

Tel: +972 54-6429978

Tel: +972 54-6429978

Türkiye

Tel: +90 5327764380

Tel: +90 5327764380