Intralinks for

Financial Services

More than 25 years ago, SS&C Intralinks pioneered the virtual data room for strategic transactions. Today, we provide a full suite of secure banking solutions and managed services. Our offerings allow financial services professionals to seamlessly collaborate throughout the entire deal lifecycle.

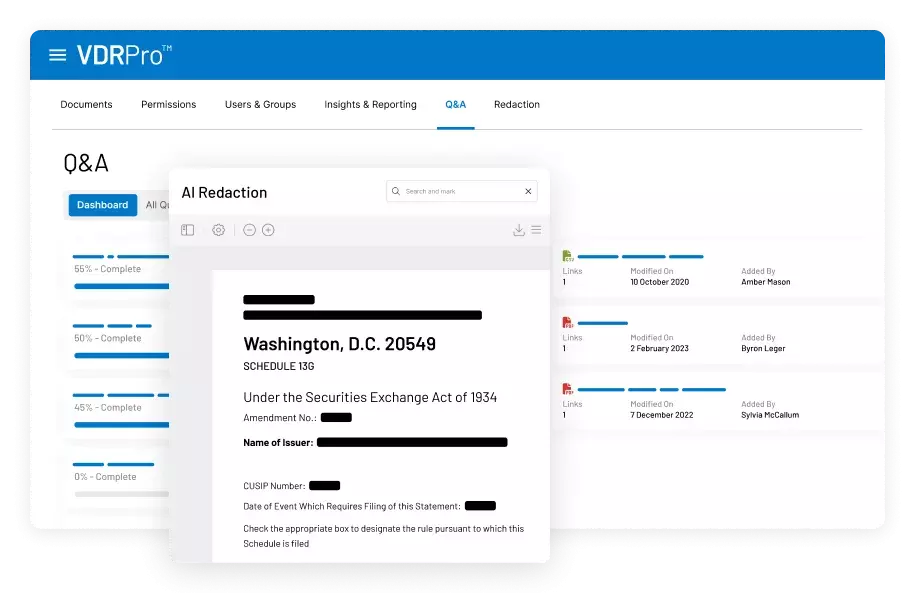

AI redaction

Quickly scan large volumes of files and pinpoint sensitive information with our AI-powered redaction engine. Simply review and confirm, then initiate bulk redaction across documents.

Full content control

Maintain ownership and control over content with granular user-permission management, customizable workflows, information rights management, watermarking and download prevention.

Purpose-driven innovation

Enhance stakeholder collaboration and ensure deal progress with smart features such as streamlined and centralized Q&A, auto notifications, “view as” a specific user and document metadata.

Comprehensive services and expert support

Our services teams are ready to help at every stage of your deal — from tactical VDR support and redactions to translations and NDAs. For more complex requirements, we offer fully customized solutions.

Integration and

open APIs

Connect to third-party and legacy systems to facilitate scheduled downloads for business partners via secure file transfer protocol (SFTP) — or auto-archive files to long-term data repositories.

Best-in-class

security

Intralinks is trusted by all global bulge bracket banks who have vetted our platform. As the first ISO 27701-certified VDR provider, we set the gold standard for data privacy.