Since the advent of the virtual data room (VDR), keyword search has been the standard way to find information: type in a term, get a list of documents and start clicking. While not perfect, it was an acceptable way to search — and an essential improvement over paper binders and physical diligence rooms. But expectations have changed.

Given the volume and complexity of today’s deals, dealmakers want to do more than locate files — they want to quickly understand what’s inside them, how information connects across documents and what it means for valuation and risk. That’s where artificial intelligence (AI)-powered discovery is transforming search — delivering deeper insights and doing so at the speed today’s deals demand.

Why do we search at all?

No one conducts a search for its own sake — they’re looking for answers. When an analyst types in “change of control,” the goal isn’t to count keyword mentions. It’s to determine whether a contract contains provisions that could, for example, trigger termination rights or impact cash flows if the company is acquired.

Search is just a means to an end. What matters is the real intent behind the query: What are the risks? Where are the gaps? How does this impact value? Traditional search forces dealmakers to translate that intent into keywords and hope the results line up. But too often, they don’t, making it easy to miss differently worded results, or overlook patterns that emerge only when information is connected across documents.

That’s where AI changes the game. Instead of asking you to guess the right terms, AI allows you to ask the actual question in plain language — and delivers an answer grounded in context.

From results to insights

The difference may sound subtle, but for dealmakers it’s profound. With keyword search, you might get hundreds of hits — each one requiring you to open a file, scan a page and make a judgment call. With AI-enabled discovery, you can ask, “What are the key regulatory risks in our international markets?” and receive a synthesized answer drawn from multiple documents. The system recognizes relationships, financial structures and terminology, surfacing what matters most instead of what simply matches.

By shifting from long lists of keyword hits to direct, contextual answers, deal teams can spend less time sifting through irrelevant results and more time focusing on what matters. The result isn’t just faster reviews — it’s smarter decisions built on a fuller understanding of the data.

A transitional moment

For decades, document management during mergers and acquisitions (M&A) due diligence followed a familiar pattern: store files, index them and rely on keyword search to pull them back. That approach worked when the primary need was file retrieval. However, the sheer scale and complexity of today’s transactions demands more. Dealmakers need greater context and clarity around the information they’re looking up.

While some practitioners still rely on keyword search out of habit, an important shift is underway. The industry is moving toward AI-powered discovery because it provides what keyword search cannot: direct answers to complex questions. The difference between the two is stark — one produces documents, while the other fosters understanding.

What AI means for dealmakers

With AI search, dealmakers can quickly assess exposure to risks that would otherwise require hours or even weeks of manual review. For sellers, it ensures the information they’ve shared is complete and helps them anticipate the questions buyers are most likely to ask. For buyers, AI discovery delivers a faster, clearer view of risks and performance drivers, reducing the chance of overlooking critical details.

This is particularly relevant now, as dealmakers are asked to do more with less. Regulatory scrutiny is rising, timelines are tighter and stakeholder expectations are higher than ever. At the same time, transactions involve increasingly complex assets, from global supply chains to emerging technologies. In this environment, moving from document lists to decision-making without wasting effort on redundant tasks isn’t a luxury — it’s a necessity.

Experience intelligent discovery

The shift from search to discovery represents more than a technological upgrade — it’s a mindset shift from simple retrieval to rapid understanding.

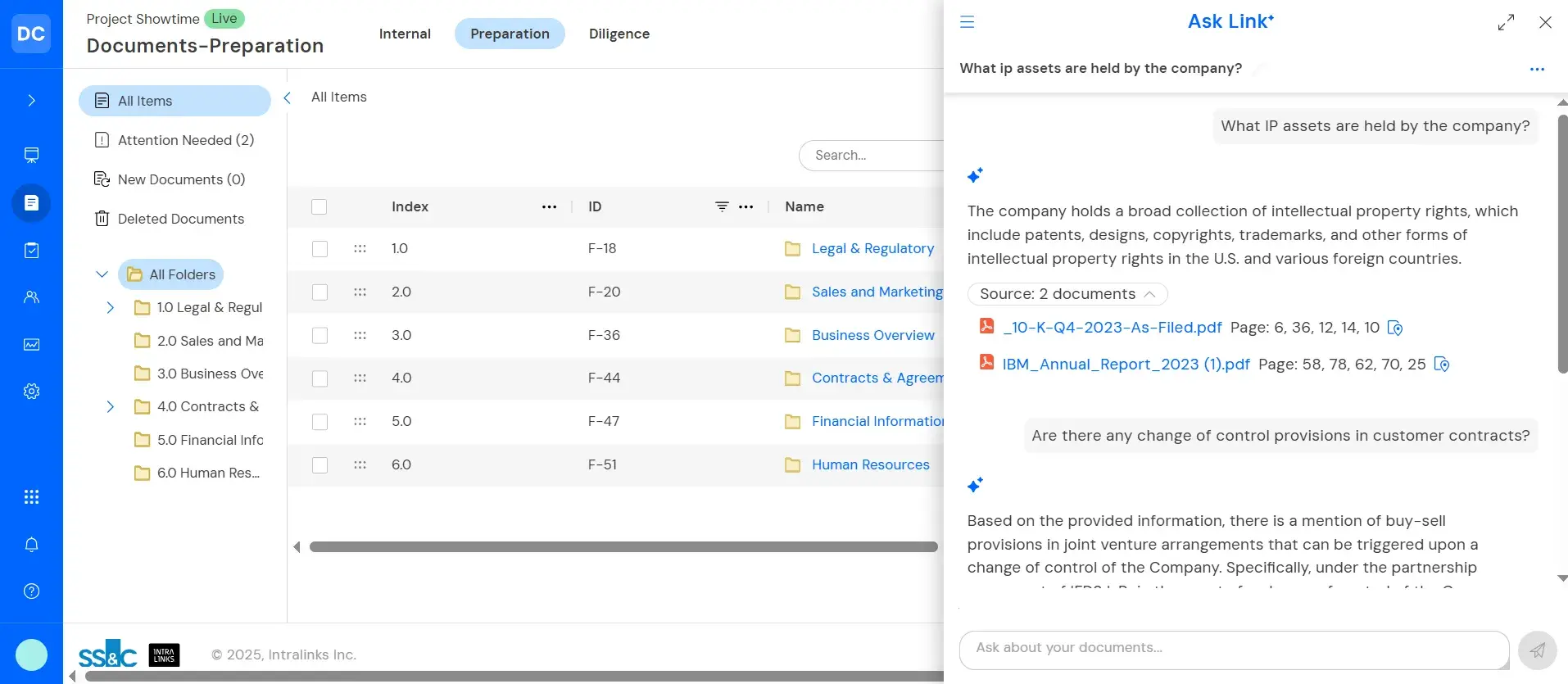

At SS&C Intralinks, we are leading this revolution. Our vision is to not only provide dealmakers with access to content, but the intelligence they need to act on it. That means bringing together Ask Link, our proprietary AI-powered search engine, with metadata search and structured workflows like document request lists — creating an ecosystem designed not just for locating files, but for true discovery.

The future of M&A due diligence isn’t about generating longer lists of keyword hits. It’s about getting clear, contextual answers that drive desired outcomes.

Want to see what this future looks like in practice? Learn more about how Intralinks is reshaping the M&A process with DealCentre AITM, our end-to-end dealmaking platform.