Madison Street Capital & Farragut Capital Partners

Intralinks connects a privately-held investment firm with a boutique investment bank to secure a high-value mezzanine financing deal

SITUATION

In the world of mezzanine investments, finding the right deal sometimes can be arduous and time consuming. Or, as private investment firm Farragut Capital Partners discovered, it can be quick and easy. Intralinks for Deal Sourcing can be the difference-maker.

Farragut targets the lower-middle market, focusing on mezzanine and equity investments with most deals in the range of $2-8 million of EBITDA (Earnings before Interest, Taxes, Depreciation and Amortization). Closing five or six deals per year, the firm emphasizes quality over quantity, but its previous deal sourcing platform simply wasn’t delivering enough high-quality deal flow.

Phil McNeill, Farragut’s Managing Partner, explains, “We like to look at companies that are efficient with their assets and maintain high-quality cash flow. They tend to be represented by boutique investment bankers, which are often hard to reach.”

Investment banking firm Madison Street Capital (MSC) had an opportunity that was perfect for Farragut. The problem was the firms didn’t know each other. MSC, which also focuses on the lower-middle market, had a consumer brand client with strong, stable cash flow. Barry Petersen, Senior Managing Director with Capital Markets at Madison Street Capital, notes, “We pride ourselves on leaving no stone unturned when it comes to identifying institutional parties that may have interest in our client. But it’s very difficult to ensure contact with 100 percent of potential investors. Intralinks ensures this additional requisite reach is accomplished.”

SOLUTION

MSC and Farragut registered with Intralinks, the world’s largest global online deal sourcing solution. Within a couple days of setting up its investment criteria, Farragut received an Intralinks email alert that included an attractive opportunity offered by MSC. McNeill messaged Petersen through the Intralinks and within two days they were in serious discussions.

“In this situation we received strong interest given the high quality opportunity,” says Petersen. “Even though other term sheets we received were competitive, Farragut delivered the best fit and terms for our client.”

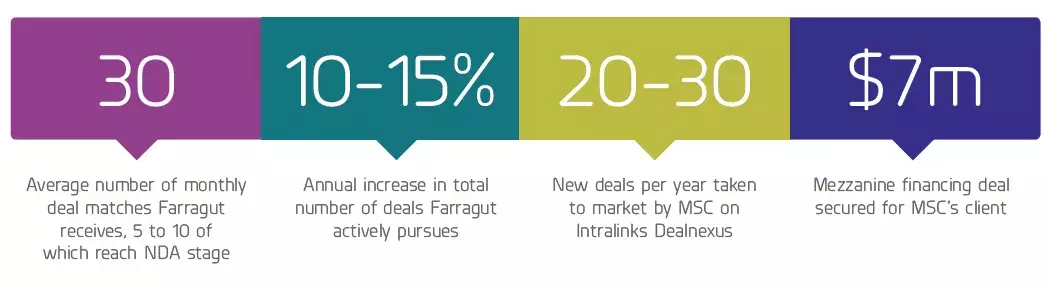

The deal closed two months later—a remarkably fast turnaround. Farragut provided nearly $7 million in mezzanine financing for MSC’s client, Hatch Chile, a branded packaged food company that markets, sells, and distributes Mexican-style food products. The mezzanine investment refinanced existing debt and provided much-needed capital for Hatch to expand its growing business.

BENEFITS

Intralinks served up a valuable deal opportunity that Farragut might otherwise not have found. In fact, it led Farragut into a new market, expanding the breadth of the firm’s portfolio.

“We haven’t historically focused on consumer products,” McNeill notes. “Intralinks allowed us to see an opportunity that fit our investment criteria in an area we don’t normally look at while increasing our exposure to asset-light companies—a key market for us. One of the biggest benefits of Intralinks is facilitating conversations with parties we don’t know.”

Likewise, the solution matched MSC with an ideal investor for its client, which required cash flow lending relatively few investors provide.

“Intralinks ensures that we’re getting as high a level of contact as possible with potential investors for our clients,” notes Petersen. “There are new investment parties coming online every day and there’s really no other way we could possibly keep up with all of them. Most likely, they’re going to be on Intralinks.”

Both firms also value the quality and efficiency of the deal flow Intralinks delivers. For Farragut, Intralinks yields on average 30 potential deals per month of which 5 to 10 are actively pursued and result in an NDA.

“With Intralinks, we’re getting 10-15 percent more deals each year worth pursuing than when we relied solely on direct contacts,” McNeill reports. “Because we can filter results tailored to our investment criteria, I’m not wading through a lot of irrelevant deals.”

Petersen notes that MSC takes 20-30 deals to market per year on Intralinks. “I give Intralinks the highest marks. The solution is easy to navigate, post, and manage the marketing function.”

“Plus, Intralinks is so well respected in financial circles that we know people will pay attention when we use it to assist, and support, marketing a deal,” Petersen adds.

Aside from expanding opportunities in the broader market, Farragut and MSC now have a solid relationship that is already leading to additional opportunities beyond Hatch Chile. In fact, another banker at MSC recently contacted McNeill about a promising new deal.

“We’re on MSC’s radar now, and they’re on ours,” McNeill remarks. “Intralinks builds valuable relationships like this. And we trust we’ll see more such relationships develop just by being a member of the network.”