@VISORY partners used Intralinks to accelerate negotiations in mid-cap M&A deals

SITUATION

@VISORY partners had been using several different virtual data room (VDR) companies to conduct its M&A business, but were seeking one data room provider that could cover all the necessary functions for their different types of projects and clients.

SOLUTION

For the past two years, the @VISORY M&A team has increasingly used Intralinks as one of their main VDR solutions because it offers a comprehensive set of functions and is very user friendly, allowing their clients and potential business partners to jump into the negotiation process more quickly.

“Intralinks is much more intuitive than several competitors’ data rooms. You can learn by doing,” an @VISORY analyst said. “Most of the other VDRs we’ve tried were far more complicated to use. We needed multiple-hour sessions just for the introduction. Using Intralinks has been much easier and smoother.”

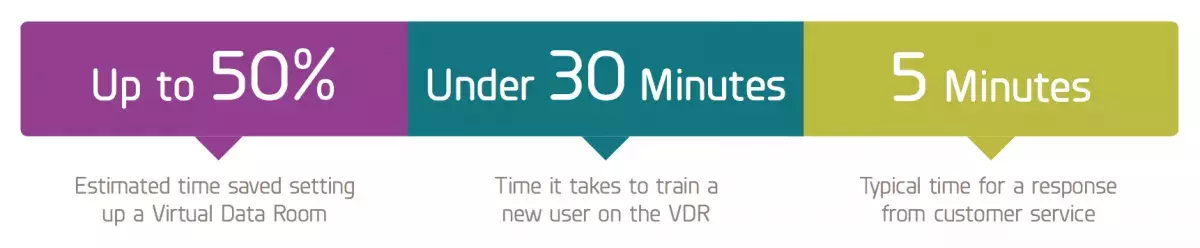

“Now, we just give all parties the Intralinks Quick Guide – a Q&A guide for buyers– to show them how to use the VDR,” he added. “This introduction takes only about 20-30 minutes and covers all the basics for potential investors and due diligence providers to start working right away.”

BENEFITS

To @VISORY, the most notable impact of Intralinks has been the increase in productivity during the deal preparation process. “Our time savings just for getting the data room ready is up to 50% higher than our experience with other selected VDRs,” the analyst said, estimating that he saved up to two full days in the process.

“Using the Designer tool, we drag and drop all the folders on our desktop and just upload everything at once. Often, we’ll have many folders with subfolders with two or three files in each. With Intralinks, thankfully we no longer have to recreate each folder on its own.”

Efficiency issues aside, the analyst added that the tracking and auditing functions of Intralinks give him and his team inside intelligence on their potential bidders’ level of interest, providing leverage at different stages of the negotiation process. The VDR dashboard tracks who is looking at which documents, who downloaded them, and how long they have viewed the information.

“When you’re in a very competitive situation with four or five investors in the data room and you really want to see which party is in front, you can assess how interested the different parties are. You are able to steer your potential investors or tell them they have to accelerate the process if they want to be part of the deal,” he said. “After the signing, if an investor states they never saw a document, you can refer to the history of access to all files on the platform.”

@VISORY also appreciates Intralinks’ customer service approach of assigning a personal Client Services Manager who is familiar with each company’s specific business challenges.

“What I really like about Intralinks is that we have a personal contact, someone we can always call directly if we need some help,” the analyst said. “This is the opposite of the typical customer service hotline where you’re talking to someone different each time.”

“Most of the time when I send my contact an email, the problem is solved within five minutes,” he added. “When I set up a virtual data room for a client and they are having problems, I have one hour to solve everything. It’s good to know that when I ask for help, the person on the other end cares about my problems. Intralinks is always very responsive.”