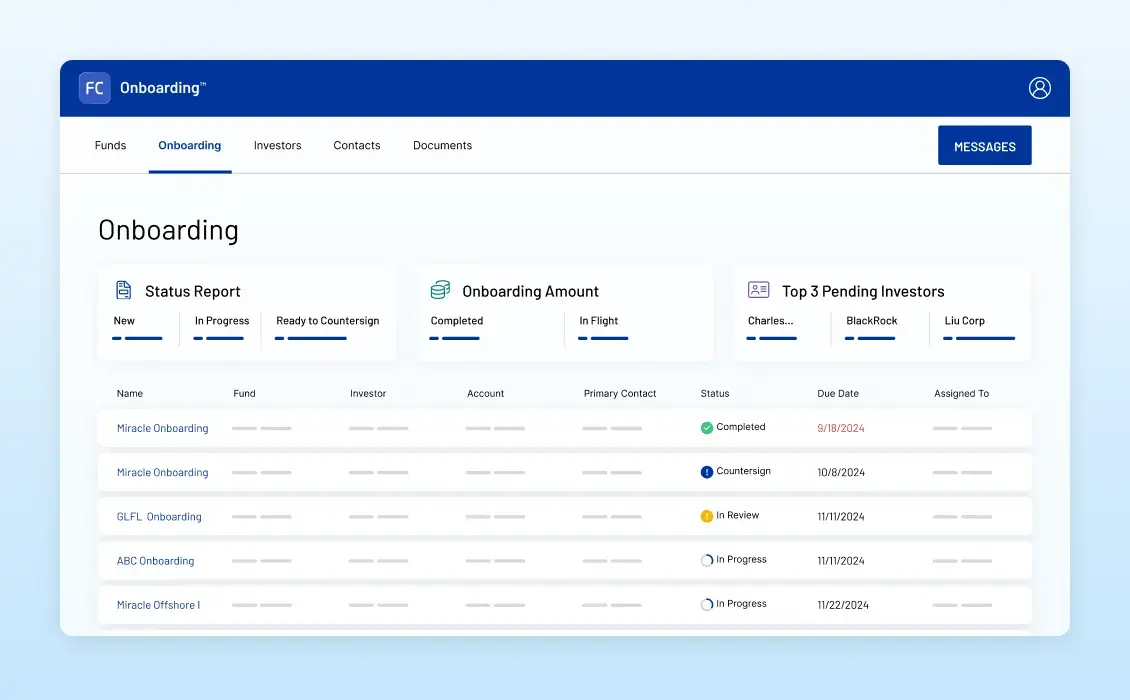

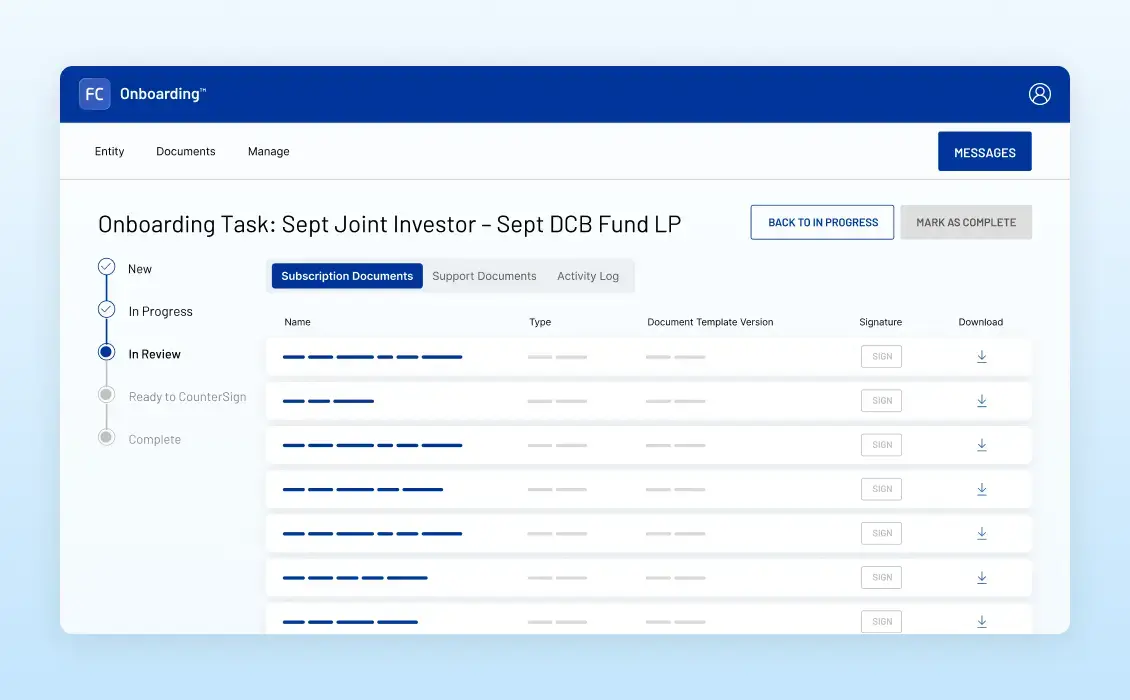

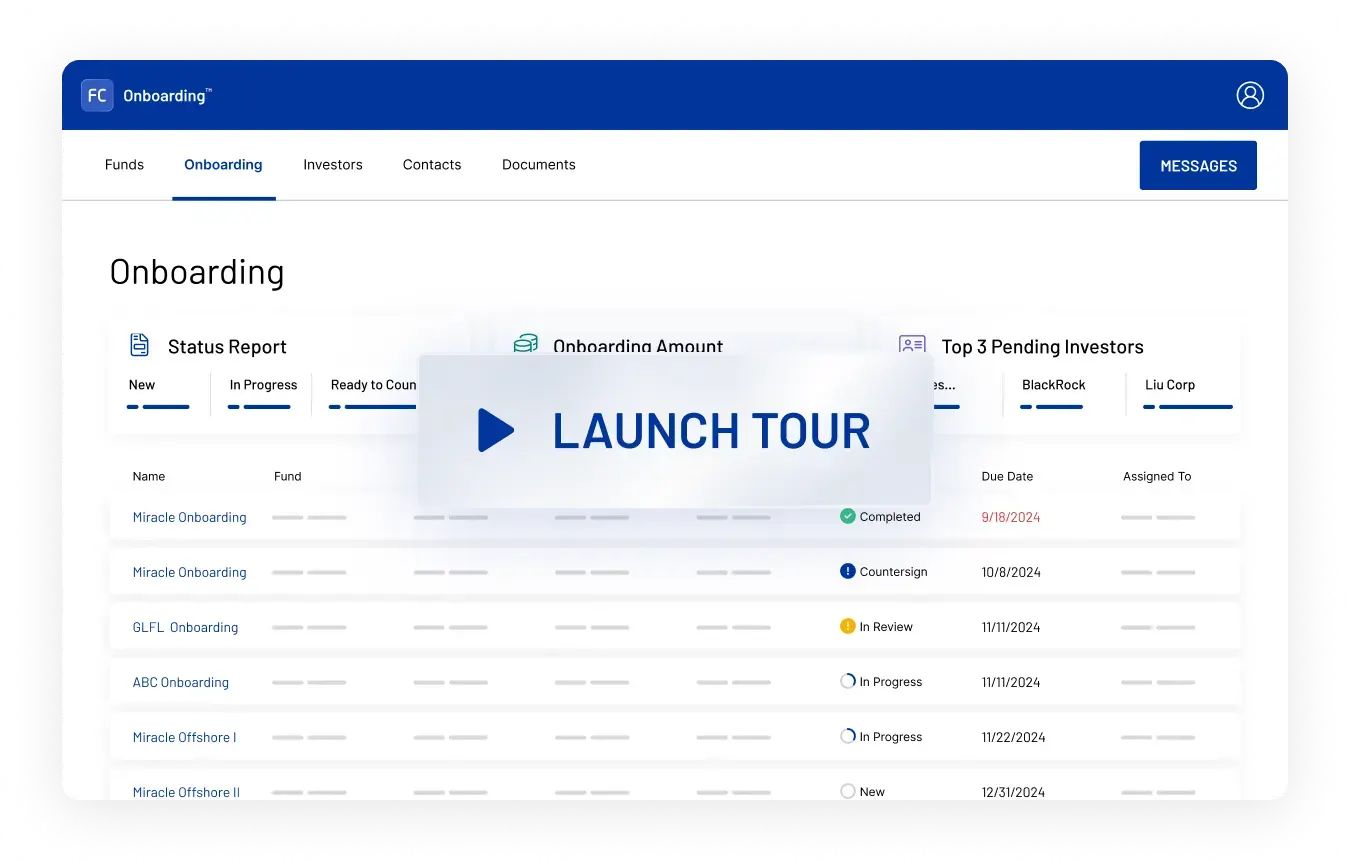

Turn commitments into capital faster with automated onboarding

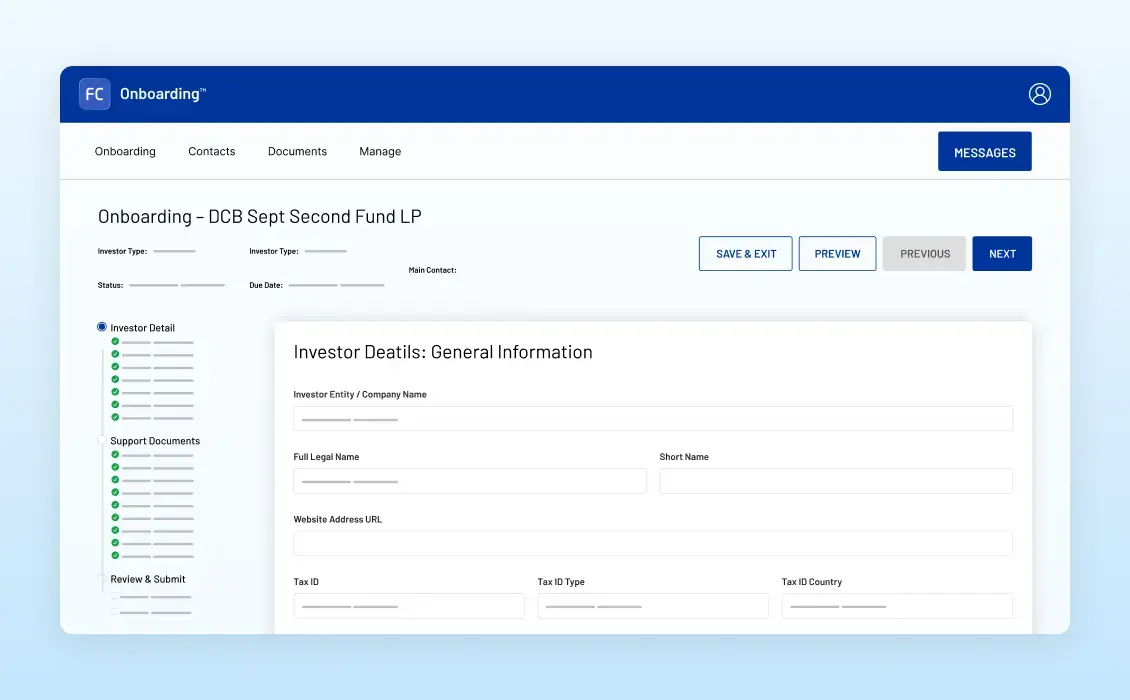

Raising capital is only the beginning — true momentum happens when investors onboard effortlessly. FundCentre™ Onboarding helps fund managers accelerate closings, simplify subscriptions and AML/KYC compliance, and deliver a faster, smarter, more transparent investor onboarding experience.

How does FundCentre Onboarding compare?

In today’s competitive fundraising environment, speed and precision matter. SS&C Intralinks’ FundCentre Onboarding streamlines investor subscriptions so you can close faster, deploy capital sooner and stay fully compliant. Discover how our onboarding solution outperforms the competition — and why 9 out of 10 of the world’s leading global PE firms choose FundCentre.

| Category | Feature | FundCentre Onboarding | Competition | |||

|---|---|---|---|---|---|---|

| Subscription document management and workflow | Generate and deliver digital fund subscription packages directly to investors | |||||

| Create custom workflows with conditional logic | ||||||

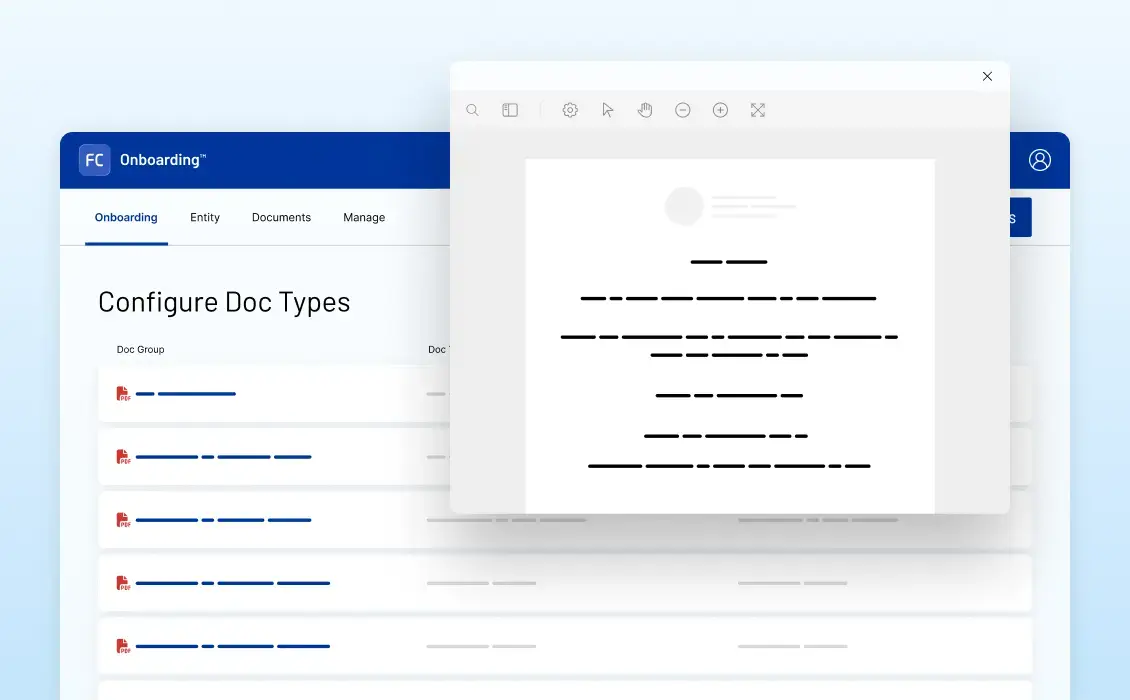

| Map subscription documents and generate templates for recurring workflows with ease | ||||||

| View, approve and digitally sign documents using DocuSign | ||||||

| Collect investor data once and reuse it across multiple documents | ||||||

| Ensure complete data capture with distinct GP and LP workflows | ||||||

| Gain real-time onboarding insights through intuitive dashboards | ||||||

| Sign and countersign documents seamlessly | ||||||

| Use smart forms that automatically adapt to investor type or jurisdiction | ||||||

| Investor experience | Modern, intuitive interface | |||||

| Single login across all GPs | ||||||

| In-app messaging, commenting and notifications | ||||||

| Customize documentation requirements for every LP type, jurisdiction and risk rating | ||||||

| Auto-fill documents with data stored in the investor profile | ||||||

| Dynamic screens reduce manual input for investors | ||||||

| Guided workflows lead investors through sub-documents, ensuring they complete only the relevant sections | ||||||

| Regulatory compliance | Collect the data needed to meet KYC/AML requirements | |||||

| Track beneficiaries, controlling persons and close associates | ||||||

| Maintain a complete history log of all notifications and messages | ||||||

| Leverage a built-in risk rating calculator and country risk profiles | ||||||

| Assess potential investor risk levels based on jurisdictional profiles | ||||||

| Reporting & analytics | View and track the status of onboarding tasks | |||||

| Export onboarding packages with populated sub-documents, supporting documentation and data extracts | ||||||

| Bulk export investor onboarding task data for streamlined transaction processing | ||||||

| Customer experience | 24/7 comprehensive support in 140+ languages | |||||

| Dedicated project managers to guide implementation | ||||||

| Professional services team to assist with document mapping and supporting document rule configuration | ||||||

| Fast, seamless implementation process | ||||||

| Flexible technology that scales with your firm’s growth | ||||||

| Robust product roadmap and continuous development | ||||||

| Enterprise integrations and security | ISO 27701-certified | |||||

| Secure document and data management | ||||||

| Bank-grade security standards | ||||||

| Automatic audit trails for full transparency | ||||||

| Role-based user permissions for streamlined management | ||||||

| Controlled access for legal counsel and fund administration partners | ||||||

| Seamless data sharing across FundCentre and other systems via APIs | ||||||

| See More | ||||||

| See Less | ||||||