DealCentre AI, VDRPro, and InvestorVision Product Enhancements

August 26, 2025

6 min read

Highlights include:

DealCentre AI

AI Powered Q&A

Reduce one of the most time-consuming parts of the deal process. Benefits include:

- A quick set-up process.

- An intuitive interface with real-time workflow tracking for streamlined operations.

- AI automatic detection of similar questions.

- Advisors can view previously answered questions and reuse response attachments.

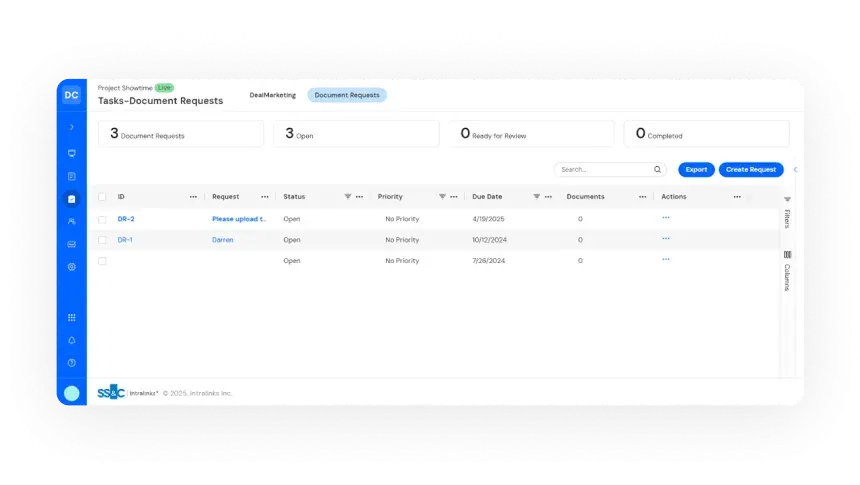

- Document Request List and Review – now powered by LINK

- Advisor issues a document request, seller uploads and then status moved to ‘Ready to Review.’

- AI then checks whether the uploaded file matches the requested document, helping streamline the review process and reduce back-and-forth.

- Ask Link Copy Format

- AI Generated responses, formatted tables and summaries can now easily be copied directly into reports or presentations with formatting intact.

- Notifications & Alerts

- Deal administrators can view and modify notification settings for each deal separately. This enables them to determine how and when participants—including deal team members, buyers, and sellers—receive notifications related to new deals, document and folder permissions and uploads, as well as scheduled reports.

- Users receive alerts either via email or through the In-App Notification Center (accessible by clicking the bell icon).

- Usage Widget Transparency

- Page count conversion ratios are now displayed within the Usage Widget, allowing Advisors to see how VDR usage is calculated at the deal level. This update offers additional transparency to assist advisors with managing VDR costs for their clients.

- Provisioning Multiple Users

- Up to 10 users can be provisioned during initial setup of DealCentre AI by Sales or Customer Success.

- Push to Diligence upon Upload

- Deal team members can select a diligence preference - “push now” or “push later” - from the preparation area, streamlining the workflow when uploading documents.

- Replace Documents in Diligence

- Deal team members can now directly replace diligence documents while retaining identical permissions, eliminating the need to upload new files in preparation and manually grant permissions.

VDRPro

Clarity & Convenience with Permission Overrides

- Permission overrides are now displayed at the folder level providing clearer visibility into permission changes.

- Advisors can now easily revert overrides directly from the Permissions screen, ensuring efficient and streamlined permission management.

FundCentre

InvestorVision

- A unified view of investors:

- Create a consolidated profile for each investor by removing duplicates from different data providers. This is vital for clients managing multiple funds, as one investor may appear in both hedge fund and private equity structures with inconsistent information across systems like SS&C. Previously, we blocked postings for investors listed in multiple sources, leading to manual name changes and resulting in misaligned records and reporting issues.

- Semi-Annual Uploads:

- In addition to the monthly and daily uploads introduced last quarter, Semi-Annual uploads are now available, complementing the existing quarterly default uploads. This update accommodates clients such as Select Equity Group who require multiple reporting cadences based on their fund strategies.

- Document Visibility: Who’s Viewed and Who Hasn’t:

- Easily track who has opened a document and who hasn’t, ensuring nothing slips through the cracks. This visibility is especially critical when urgent action is required.

Fundraising

Enhancements have been made for both GPs and LPs:

- For General Partners (GPs):

- API support now extends to contacts and activities alongside funds and campaigns, allowing GPs to monitor LP engagement.

- Bulk grant permissions at the fund level and quickly add investors, contacts, or companies via a pop-up without leaving the workflow.

- For Limited Partners (LPs):

- Fast access to document links.

- Improved LP Portal with a streamlined table and hierarchical document view for easier navigation.