Intralinks for M&A due diligence

Simple, smart, secure

Our fast, flexible and intelligent VDR drives due diligence for the full range of strategic transactions — including mergers and acquisitions (M&A), divestitures, financing, corporate restructurings, spin-offs, joint ventures and strategic partnerships.

Features and benefits

Built for global dealmaking

Simplify cross-border diligence with seamless and compliant workflows. With over 3.1 million registered users and 10,000 transactions annually, chances are your counterparties are already part of the Intralinks community.

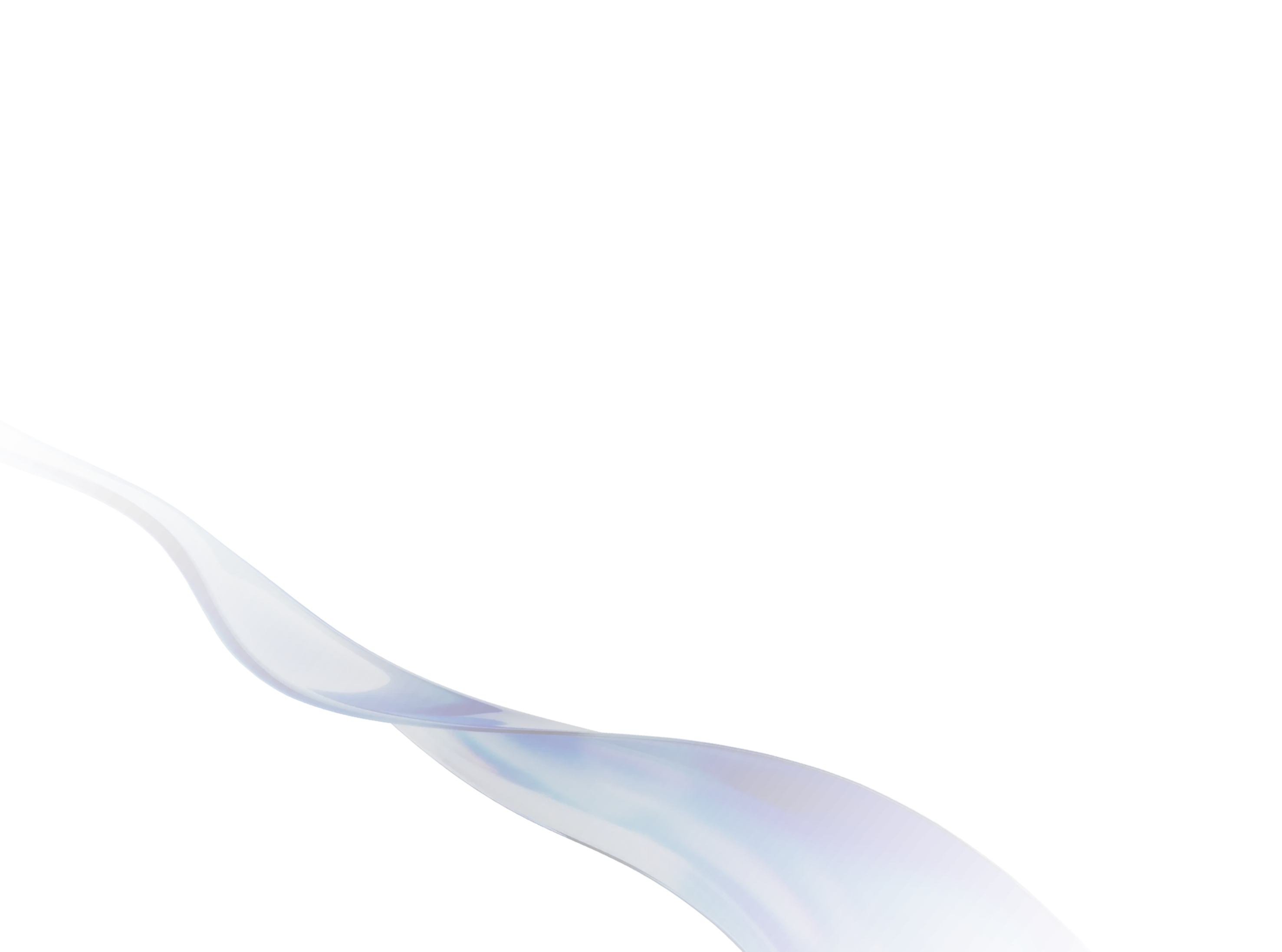

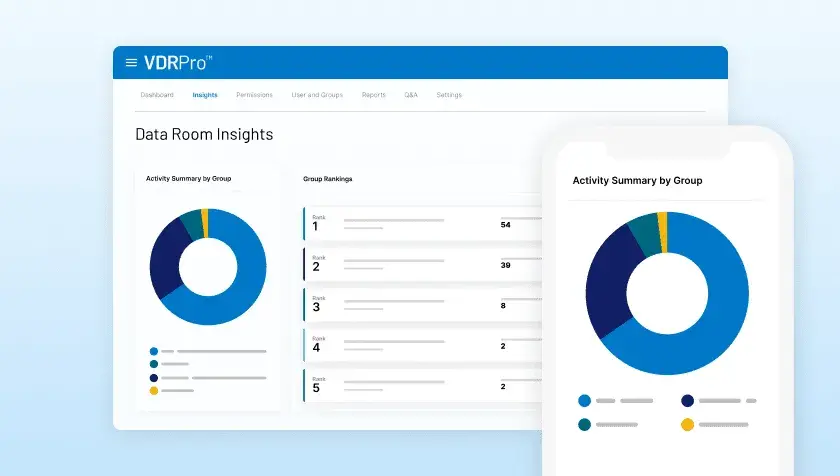

Full visibility and control

Stay on top of your transaction at every stage. With intuitive indexing, Q&A, permission controls and built-in reporting, Intralinks enables real-time tracking of deal progress and user activity.

Bank-grade security

Trust is critical in M&A deals, and protecting your sensitive data is our priority. As the first VDR provider to achieve ISO 27701 and TISAX certifications, Intralinks is backed by over 5,300 successfully completed independent security audits.

Streamlined Q&A

When buyers need answers fast, speed matters. Intralinks routes inquiries to the right experts, prioritizes urgent requests and provides full visibility of the process with role-specific dashboards.