Opportunity Is Knocking for Tech M&A in the Middle East

20 September 2021Digitization is driving confidence for dealmaking in the region.

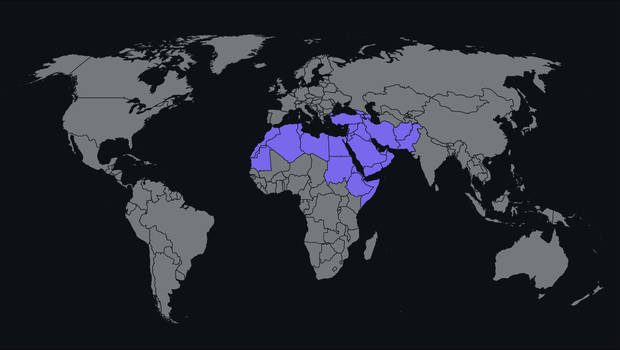

As the COVID-19 pandemic triggers consolidation in the Technology sector, mergers and acquisitions (M&A) activity in the Middle East and North Africa (MENA) region is expected to remain strong through the end of 2021. Tech has been growing rapidly and is expected to see more successful exits through initial public offerings (IPOs) or new rounds of funding.

Dealmakers have pointed to accelerated digitalization as a key driver of M&A activity in Tech and related sectors. The post-pandemic surge in M&A has left many deal teams overworked and under intense pressure to finalize deals. However, dealmaking has been resilient and is pushing forward the acceleration of digital transformation in the region.

Saudi Arabia, as well as the United Arab Emirates (UAE) have experienced increased M&A activity. Deals in the Oil & Gas sector have increased 65 percent YOY. The M&A market has also seen consolidation in the Education sector, where bigger players are taking over smaller schools that are struggling to cope amid the pandemic. The Healthcare sector remains highly attractive due to its robust performance.

Deal drivers and the state of valuations

The feverish activity is being driven by several factors, including a backlog of transactions delayed or postponed due to the COVID-19 pandemic as well as consolidation pressure created by the crisis. The latter has forced many corporates to revise their long-term strategy and reconsider the prospects of surviving on their own.

Companies are also amplifying the need for a healthier balance sheet. Several firms in Saudi Arabia and the UAE are taking the IPO route in primary or secondary offerings. In Egypt, government regulation may also result in bank consolidation. The Central Bank of Egypt (CBE) has set a minimum capital requirement of EGP five billion (USD 318 million) which banks must achieve in phases before 2023.

Valuations have not fluctuated greatly In Saudi Arabia. Private-market M&A has maintained more focus on the business than on deal value. However, there has been an increase in valuations among Commodities, specifically Petrochemical, Mining, Oil and Gas.

Sectors here that present good opportunities for the next quarter are Family Businesses, Government-Related Entities (GREs), private-sector opportunities, Real Estate and Public Investment Fund (PIF) assets. Healthcare, Consumer Retail and Oil and Gas are all keeping dealmakers busy as well.

The pipeline for the second half of the year has been strong in MENA, and the mood among clients in the region reflects optimism — despite due diligence taking longer due to reduced travel and social distancing. Local hosting has been a particular challenge in Saudi Arabia.

Lastly, there has been a pick-up in regional PE activity over the past few months, with interest in the Technology, Pharmaceutical, Hospital and Entertainment-related sectors.

You can read our M&A market prediction for the coming quarter in the newly published SS&C Intralinks Deal Flow Predictor for Q4 2021.

In addition to a guest comment by two Committee for Foreign Investment (CFIUS) experts — Michael Rose and Nina Kelleher from EisnerAmper — there’s also a timely spotlight on inflation’s potential impact on M&A. Is the pick-up in inflation stopping deals or encouraging them?

Find out more by downloading the report here.

Taufik El-Abed

As sales director for the U.K., Ireland and Middle East markets, Taufik is focused on empowering dealmaking professionals to leverage technology with complete control and confidence. Taufik has 14 years of enterprise solution experience at leading software companies in their respective fields, such as OpenText, Alfresco and Privitar. During his career, he has supported companies through the adoption of cloud computing services and solutions to help organizations to improve workflow and productivity. He specializes in data security and privacy.