Why General Partners Should Focus on Digital Transformation

17 June 2022

It’s no secret that fund managers haven’t exactly been on the cusp of technological adoption. A white paper published in 2017 by PwC titled Asset & Wealth Management Revolution: Embracing Exponential Change went as far as to describe the private markets as "digital technology laggards."

The COVID-19 pandemic gave a wake-up call for many in alternative investments: Digitally transform or face potential consequences.

Since then, there has been a modest improvement in the adoption of new technologies by general partners (GPs). However, some firms still rely on a hodgepodge of tools from the 20th century to accomplish modern-day tasks. It’s risky, and it doesn’t need to be this way.

In a fast-moving marketplace where competition for investors’ attention and capital is fierce, savvy GPs see value in investing in tech. With so many shifts in the market, GPs are seeing the ROI from digital tools that allow teams to act nimbly and swiftly to satisfy investor demands.

As investors become increasingly more discerning amid a volatile market, whether a GP realizes it or not, their tech stack could make or break an investment — or their firm.

Time-draining clerical tasks can be left to automation, increasing efficiency, mitigating risk and allowing teams to focus on higher-level tasks and ultimately, the investor.

A make-or-break moment

With our 240,000+ strong community in mind — the largest in the world — SS&C Intralinks recently introduced FundCentre™, a suite of solutions tailored to fund managers.

Instead of a GP juggling a host of solutions that weren’t designed to work together, the purpose-built FundCentre seamlessly integrates capital raising and investor onboarding, investor reporting and communications, dealmaking, fund administration and portfolio monitoring across an entire fund.

As investors become increasingly more discerning amid a volatile market, whether a GP realizes it or not, their tech stack could make or break an investment — or their firm.

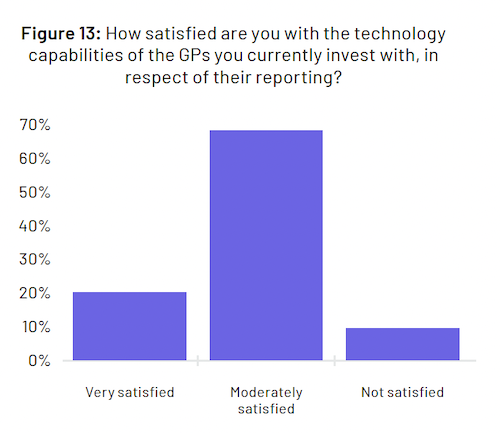

(Above) Source: SS&C Intralinks 2022 LP Survey

According to the SS&C Intralinks 2022 LP Survey produced in association with Private Equity Wire, over 80 percent of 199 limited partners (LPs) polled said it’s important that GPs embrace technology to improve the quality of portfolio reporting. Our research also revealed that LPs would like to see improvement in the due diligence process and the quality of ESG data.

As the bar for investors’ expectations rise, so will communication and the volumes of sensitive data that need to be shared.

In an evolving regulatory landscape filled with firms trying to scale, those that embrace tech are well-positioned to reap the benefits of digital investments in their organizations.

Meghan McAlpine

As Sr. Director of Strategy and Product Marketing for Intralinks, Meghan McAlpine is responsible for the go-to-market strategy and driving the growth of the company’s Alternative Investments solution, the leading communication platform for private equity and hedge fund managers and investors.

Prior to joining Intralinks, Meghan worked in the Private Fund Group at Credit Suisse. While at Credit Suisse, she raised capital from institutional and high net worth investors for domestic and international private equity firms.