What Is the SS&C Intralinks Deal Flow Predictor?

21 July 2015A quarterly prediction of future trends in the global M&A market

What is the SS&C Intralinks Deal Flow Predictor?

The SS&C Intralinks Deal Flow Predictor tracks global M&A sell-side mandates and deals reaching the due diligence phase prior to public announcement, providing a unique leading indicator of future global deal activity. The SS&C Intralinks Deal Flow Predictor is based on the company’s insight into a significant percentage of M&A transactions in their initial phases.

The statistics contained in the SS&C Intralinks Deal Flow Predictor represent the volume of virtual data rooms (VDRs) created, or proposed to be created, through Intralinks or other providers. The VDRs are used to conduct due diligence on proposed transactions including asset sales, divestitures, private placements, financings, capital raises, joint ventures, and partnerships. These statistics are not adjusted for changes in Intralinks’ share of the VDR market or changes in market demand for VDR services.

However, we have found that the SS&C Intralinks Deal Flow Predictor provides a unique and reliable prediction of future announced mergers and acquisitions activity.

What does the SS&C Intralinks Deal Flow Predictor report?

The SS&C Intralinks Deal Flow Predictor reports quarterly variations in the number of VDRs created or proposed to be created. This variation is reported as a percentage change from the previous period. Creation of a VDR occurs in the early stages of conducting a strategic transaction before a deal is publicly announced and as such, provides a forward-looking prediction of future deal activity. As a leading global provider of VDRs, Intralinks has a unique view of this activity. (In some respects, the SS&C Intralinks Deal Flow Predictor data is analogous to the employment reports published by ADP and others, based on actual transactional payroll data, which give an indication of employment trends.) The SS&C Intralinks Deal Flow Predictor reports global deal activity, as well as regional breakdowns for North America, Latin America, Asia Pacific & Japan (APJ) and Europe, Middle East & Africa (EMEA). Intralinks also reports industry sector indicators where there are significant changes in sector activity.

How does the SS&C Intralinks Deal Flow Predictor account for deals Intralinks is not involved with, or for the fact that many deals never get announced or fail to close?

The SS&C Intralinks Deal Flow Predictor takes account of VDRs created on Intralinks platform, as well as those deals that Intralinks becomes aware of in the sales process that choose an alternative solution. Combined, Intralinks has visibility into a significant percentage of M&A transactions including a disproportionate share of the larger deals that are the bellwethers of M&A activity. Although a portion of deals reaching due diligence is never announced or completed, deals that reach the stage in which a virtual data room is needed are generally serious, with potential buyers identified and engaged in the market. Reports from our M&A clients suggest that deals reaching the due diligence stage are highly likely to close. In addition, Intralinks only reports the percentage change in deal volume year-over-year, not the absolute volume of deals.

Does the SS&C Intralinks Deal Flow Predictor accurately forecast future announced deal activity?

Yes. We believe the SS&C Intralinks Deal Flow Predictor has been a reliable predictor of future announced deal activity.

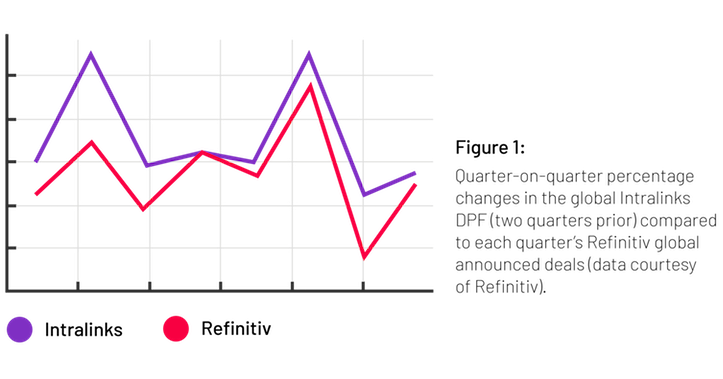

To show the predictive nature of the SS&C Intralinks Deal Flow Predictor, we compared the SS&C Intralinks Deal Flow Predictor data with subsequently announced deal volume reported by Refinitiv. Refinitiv monitors deal flow, market trends and deal activity by region, asset class or industry vertical, and gives an accurate retrospective picture of announced deal activity.

By comparing the SS&C Intralinks Deal Flow Predictor data with subsequent deal activity reported by Refinitiv, we are able to validate our belief that the SS&C Intralinks Deal Flow Predictor data is an accurate predictor of future announced M&A activity.

We compared the SS&C Intralinks Deal Flow Predictor data with Refinitiv announced deal data and found that there is a clear correlation (see below).

Predicting deals: Intralinks' deal volume forecast versus Refinitiv's reported volume of announced deals

To verify the predictive nature of the Intralinks Deal Flow Predictor, we compared the data underlying the SS&C Intralinks Deal Flow Predictor with subsequent announced deal volume data reported by Refinitiv to build an econometric model (using standard statistical techniques appropriate for estimating a linear regression model) to predict the future reported volume of announced M&A transactions two quarters ahead, as recorded by Refinitiv.

We engaged Analysis & Inference (“A&I”), an independent statistical consulting and data science research firm, to assess, replicate and evaluate this model. A&I’s analysis showed that our prediction model has a very high level of statistical significance, with a more than 99.9 percent probability that the SS&C Intralinks Deal Flow Predictor is a statistically significant six-month predictive indicator of announced deal volumes, as subsequently reported by Refinitiv. We plan to periodically update the independent statistical analysis to confirm the SS&C Intralinks Deal Flow Predictor’s continuing validity as a predictor of future M&A announcements.